We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The Sh180 billion Rironi-Mau Summit highway has been divided into two contracts, a move attributed to Beijing's investment rules but raising questions on transparency under Kenya's Public-Private Partnership laws.

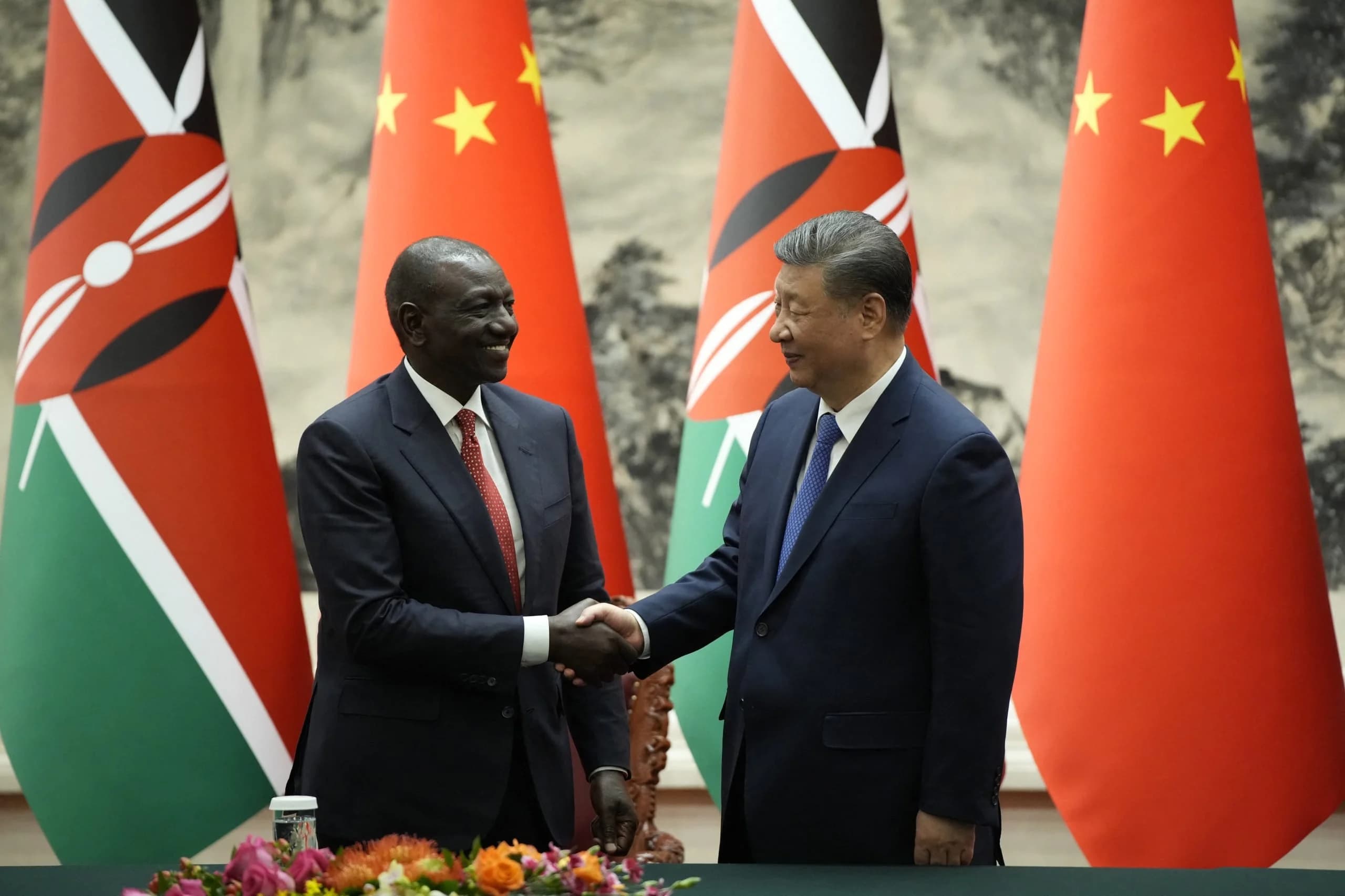

NAIROBI - The Kenyan government has quietly split the Rironi-Naivasha-Mau Summit highway project, one of East Africa's most significant infrastructure undertakings, into two separate lots ahead of its scheduled groundbreaking on Thursday, November 28, 2025, EAT. The decision to segment the massive Public-Private Partnership (PPP) project was revealed following a high-level meeting between President William Ruto and Zhang Bingman, President of the China Communications Construction Company (CCCC), on Monday, November 18, 2025.

The project will now consist of the 175-kilometre Rironi–Naivasha–Mau Summit segment and a separate 58-kilometre Rironi–Maai Mahiu–Naivasha road. Both projects will be constructed by a consortium including the China Road and Bridge Corporation (CRBC), a subsidiary of CCCC, and Kenya's National Social Security Fund (NSSF).

While the government has not issued a formal, detailed statement explaining the restructuring, sources familiar with the deal suggest the split is a workaround for Chinese internal regulations. According to measures issued by China's National Development and Reform Commission (NDRC), overseas investments by state-owned enterprises (SOEs) exceeding US$1 billion require a lengthy and bureaucratic approval process from the State Council. By dividing the estimated Sh180-200 billion (approx. US$1.5 billion) project into two smaller contracts, the contractors can potentially bypass this higher level of scrutiny in Beijing. This explanation, however, has not been officially confirmed by Kenyan transport authorities, leading to concerns about transparency.

The quiet reconfiguration of such a critical national project has drawn scrutiny regarding the government's adherence to the principles of transparency enshrined in the Public Private Partnerships Act of 2021. The Act was designed to streamline PPP processes and enhance accountability. Section 72 of the Act stipulates that any amendment or variation to a project agreement must be in writing and mutually agreed upon by the parties. While the final project agreements have not yet been signed, critics argue that a fundamental change in scope, such as splitting the project, constitutes a material variation that warrants proactive public disclosure and justification.

The law, under Section 68, mandates the publication of executed project agreements, ensuring eventual transparency. However, the lack of a clear official explanation for the split beforehand leaves critical questions unanswered about the deal's final financial structure and the rationale for the two separate concessions, both of which will be financed by Kenyan motorists through toll payments over a 30-year period. The agreed-upon toll rate is set at Sh8 per kilometre for passenger cars, with a 1% annual escalation.

This development is the latest twist for a project that has faced numerous delays and changes. In May 2025, the government officially cancelled a previous Sh180 billion agreement with a French consortium, Vinci Highways SAS, citing concerns over the financial risks and tolling structure that were deemed unfavorable to the state. Following the cancellation, which required a settlement payment of Ksh6.2 billion to the French firm, the government re-initiated the bidding process.

More recently, on October 28, 2025, President Ruto announced he had rejected the initial two-lane design proposed by the new contractors, ordering a redesign to a four- and six-lane dual carriageway to accommodate future traffic growth along the vital Northern Corridor. This redesign was cited as a reason for a delay in the project's launch.

The Rironi-Mau Summit project is a cornerstone of Kenya's Vision 2030 and is critical for easing congestion and boosting trade with Uganda and the broader region. The reliance on a Chinese SOE under a PPP model for this project highlights a significant trend. International observers and local analysts note a strategic shift by Chinese firms in Africa from being primarily state-to-state lenders to becoming long-term equity partners and operators of key infrastructure assets. This 'lenders to landlords' model, exemplified by the Nairobi Expressway, also operated by CRBC, means Chinese entities will control and collect revenue from strategic national assets for decades. While the PPP model reduces the immediate debt burden on the Kenyan treasury, it raises long-term questions about economic sovereignty and the transparency of concession agreements. As the groundbreaking ceremony approaches, the government faces pressure to provide a clearer explanation for the project's division, to reassure the Kenyan public and investors that the deal serves the national interest and adheres to the country's own governance frameworks. FURTHER INVESTIGATION REQUIRED.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago