We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Nvidia's surprise investment makes it one of Intel's largest shareholders and launches a co-development partnership aimed at redefining AI chips and challenging industry leaders.

San Francisco/Washington, United States – Nvidia stunned the semiconductor world by investing $5 billion in struggling rival Intel, acquiring roughly a 4% ownership stake and becoming one of Intel’s largest shareholders. The deal, announced after the U.S. government took a 10% stake in Intel, sent Intel’s stock soaring 23%, reflecting investor confidence in the company’s turnaround under new CEO Lip-Bu Tan.

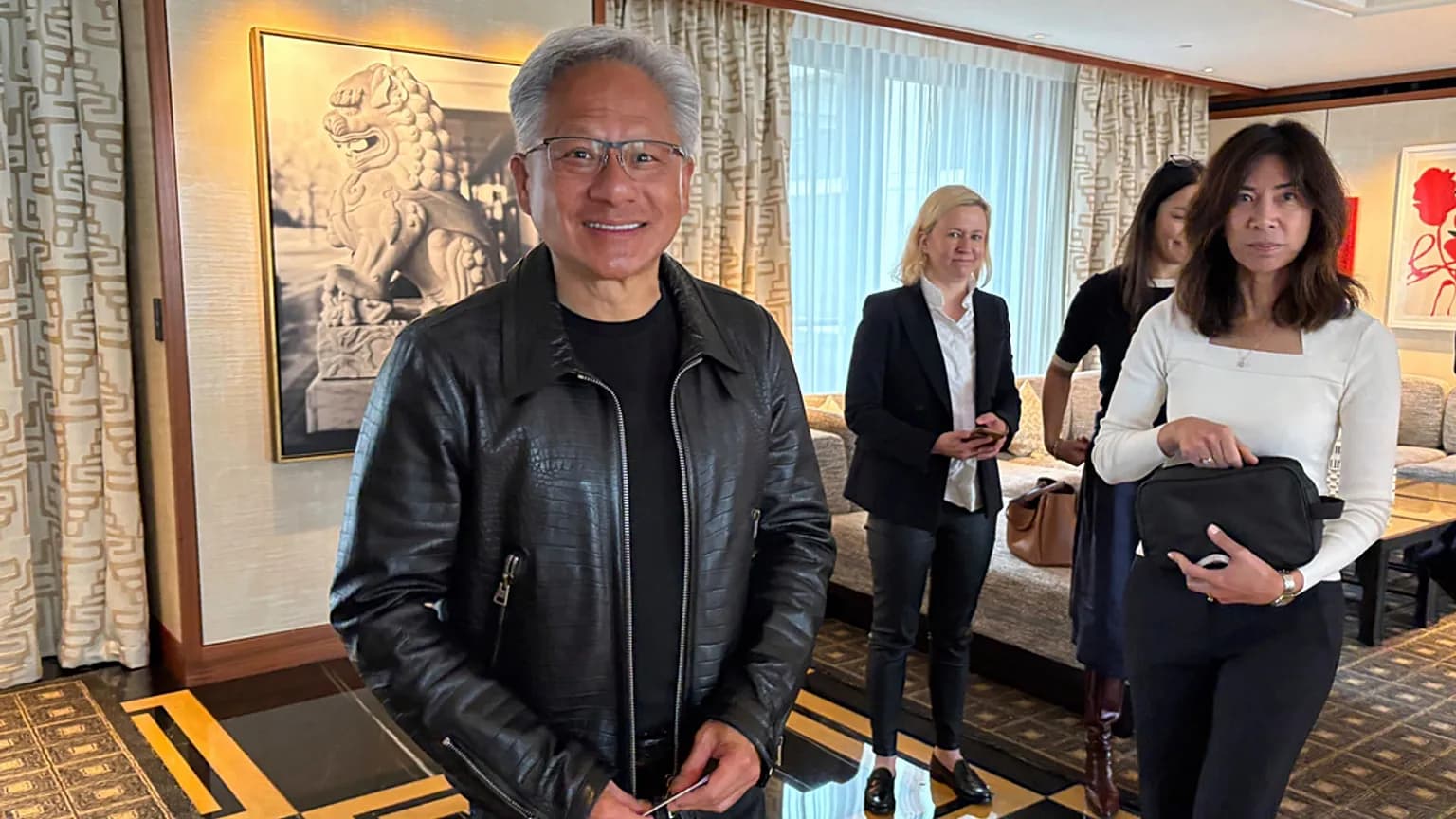

Nvidia CEO Jensen Huang clarified that the White House had no direct involvement in the deal but would likely welcome efforts to boost domestic semiconductor capabilities amid global supply chain tensions.

As part of the partnership, Nvidia and Intel plan to co-design multiple generations of PC and data-center chips.

Key components include:

Intel Foundry Services: Will provide central processors (CPUs) and advanced chip packaging.

Nvidia GPUs: Integrated using NVLink interconnect technology to deliver faster AI and high-performance computing systems.

Analysts see the collaboration as a “game-changer” for AI infrastructure, potentially accelerating innovation while reshaping global supply chains traditionally dominated by TSMC and other Asian foundries.

Industry experts warn the pact could have major consequences for existing partners and rivals:

TSMC: Risk of losing Nvidia production orders as Intel expands its foundry role.

AMD: May face intensified competition in the CPU-GPU integration space.

Broadcom & Others: Could see pressure as Nvidia-Intel products aim to dominate next-generation AI hardware.

By combining Intel’s manufacturing scale with Nvidia’s GPU leadership, the alliance could erode Asia’s dominance in advanced chip fabrication.

Nvidia will pay $23.28 per share, slightly below Intel’s latest closing price but above the level at which the U.S. government invested.

Analysts suggest this opens the door to deeper collaboration or even future consolidation among U.S. chipmakers, strengthening America’s semiconductor ecosystem in the face of geopolitical competition with China.

The partnership arrives as AI computing demand surges, requiring cutting-edge CPUs, GPUs, and interconnect technologies.

Key implications:

AI Infrastructure Leap: Combined resources could deliver unprecedented processing speeds for AI training and inference.

Geopolitical Stakes: Semiconductor supply chains are now seen as strategic national assets, especially after recent export bans targeting China.

Industry Realignment: U.S. chipmakers could form deeper alliances to counter global competition and ensure supply chain security.

Product Roadmap: First co-developed chips expected within two to three years.

Regulatory Oversight: U.S. agencies likely to review the partnership’s implications for competition and national security.

Market Reactions: Watch for TSMC and AMD responses as competitive pressures mount.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

Key figures and persons of interest featured in this article