We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Kenyan officials are heading to Washington, D.C., next week for critical discussions with the International Monetary Fund (IMF) on a new financing programme, aiming to secure support for the nation's economic stability and debt management.

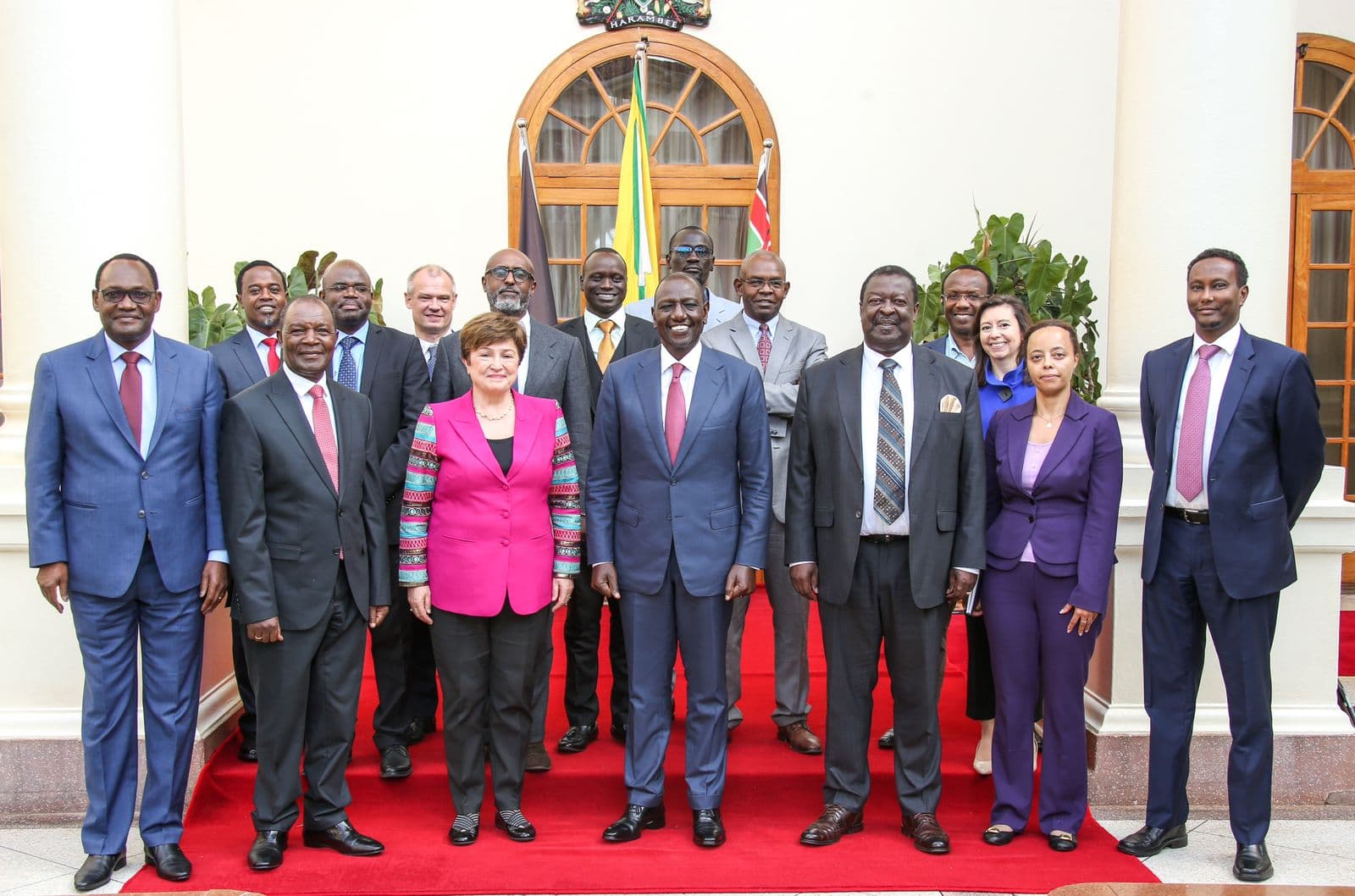

Kenya is set for pivotal discussions with the International Monetary Fund (IMF) in Washington, D.C., next week, as senior government officials from the National Treasury and the Central Bank of Kenya (CBK) seek to finalise a new financing programme. This development follows preliminary talks held in Nairobi over the past two weeks, with CBK Governor Dr. Kamau Thugge expressing optimism for a swift agreement.

The upcoming negotiations are crucial for Kenya, particularly after the expiry of its previous $3.6 billion (Ksh 464.9 billion) Extended Fund Facility (EFF) and Extended Credit Facility (ECF) programmes earlier this year. The previous facilities, worth approximately $800 million, stalled due to Kenya's inability to meet conditions related to revenue collection and deficit reduction. A new agreement is expected to include a lending component, which is vital for facilitating external debt payments and bolstering the country's financial stability amidst ongoing fiscal pressures.

Kenya has a long history of engagement with the IMF, dating back to its membership on February 3, 1964. Over the years, Kenya has entered into 22 arrangements with the IMF, highlighting a recurring need for external financial support to address macroeconomic challenges. The IMF's involvement often comes with conditions aimed at promoting macroeconomic stability, safeguarding debt sustainability, strengthening governance, and fostering inclusive growth.

The current push for a new programme comes months after the Kenyan government withdrew contentious tax hikes proposed in the 2024 Finance Bill, following widespread youth-led protests. This decision left a significant funding gap, with the government seeking Ksh 901 billion in loans to fund the 2025/2026 budget, of which about Ksh 287.4 billion is expected from foreign borrowing.

IMF programmes typically involve commitments from the borrowing country to implement specific policy reforms. These often include targets for reducing budget deficits, controlling inflation, and managing access to domestic credit. While such conditions aim to ensure fiscal discipline, they have, at times, been criticised for being overly restrictive and potentially limiting a government's flexibility in responding to domestic needs, such as investing in health and education.

Promoting good governance and anti-corruption measures remains a key aspect of the IMF's engagement with Kenya. An IMF governance diagnostic mission concluded its visit on June 30, 2025, and a draft assessment report is anticipated by the end of 2025. This report is expected to provide recommendations to enhance transparency and accountability in public finance management, an area where oversight reports have previously indicated irregularities in state-funded projects.

Central Bank of Kenya Governor Dr. Kamau Thugge confirmed on Wednesday, October 8, 2025, that senior officials from the National Treasury would participate in the Washington talks, expressing hope for a rapid agreement. IMF Mission Chief for Kenya, Haimanot Teferra, has previously affirmed the IMF's commitment to supporting Kenya's efforts towards macroeconomic stability and sustainable growth.

However, market participants have raised doubts about Kenya's ability to unlock substantial new financing, pointing to the termination of the previous arrangement and the country's near exhaustion of its borrowing limit at the Fund. As of June 2025, Kenya's outstanding credit to the IMF reached $3.02 billion (approximately Ksh 390 billion), making it the second-largest debtor to the IMF in Africa.

A successful new IMF programme could provide crucial financial backing, reassure investors, and help Kenya manage its external debt obligations. Conversely, failure to secure a favourable agreement could exacerbate fiscal pressures and potentially impact investor confidence. Some analysts suggest that even a non-funded programme from the IMF would be viewed positively, as it signifies a credible framework for structural fiscal reforms.

The conditions attached to any new loan could necessitate further fiscal tightening, which, while aimed at debt sustainability, might lead to difficult policy choices for the government, especially in light of recent public resistance to increased taxation.

The exact terms and size of the new financing programme remain unknown. There are also uncertainties regarding the extent to which the IMF's conditions will align with the government's current fiscal strategies, particularly concerning the primary balance. Some market players have questioned the necessity of a new IMF programme, especially after Kenya's recent issuance of a Ksh 193.8 billion ($1.5 billion) Eurobond to refinance existing maturities.

Discussions between Kenyan officials and the IMF are scheduled to continue next week in Washington, D.C., during the IMF's annual meetings. A team from the IMF had been in Nairobi for two weeks prior, initiating preliminary talks on the new arrangement.

Observers will be closely watching for details on the agreed-upon conditions, the size of the new financing package, and the timeline for disbursements. The outcome of these talks will significantly influence Kenya's economic trajectory, its ability to manage debt, and the government's fiscal policy decisions in the coming months.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago