We're loading the full news article for you. This includes the article content, images, author information, and related articles.

A landmark UK regulatory decision greenlights Virgin's bid to challenge Eurostar's 30-year monopoly on cross-Channel rail, signaling a new era of competition that could lower travel costs for international passengers, including those from Kenya, and offering a case study in market liberalisation.

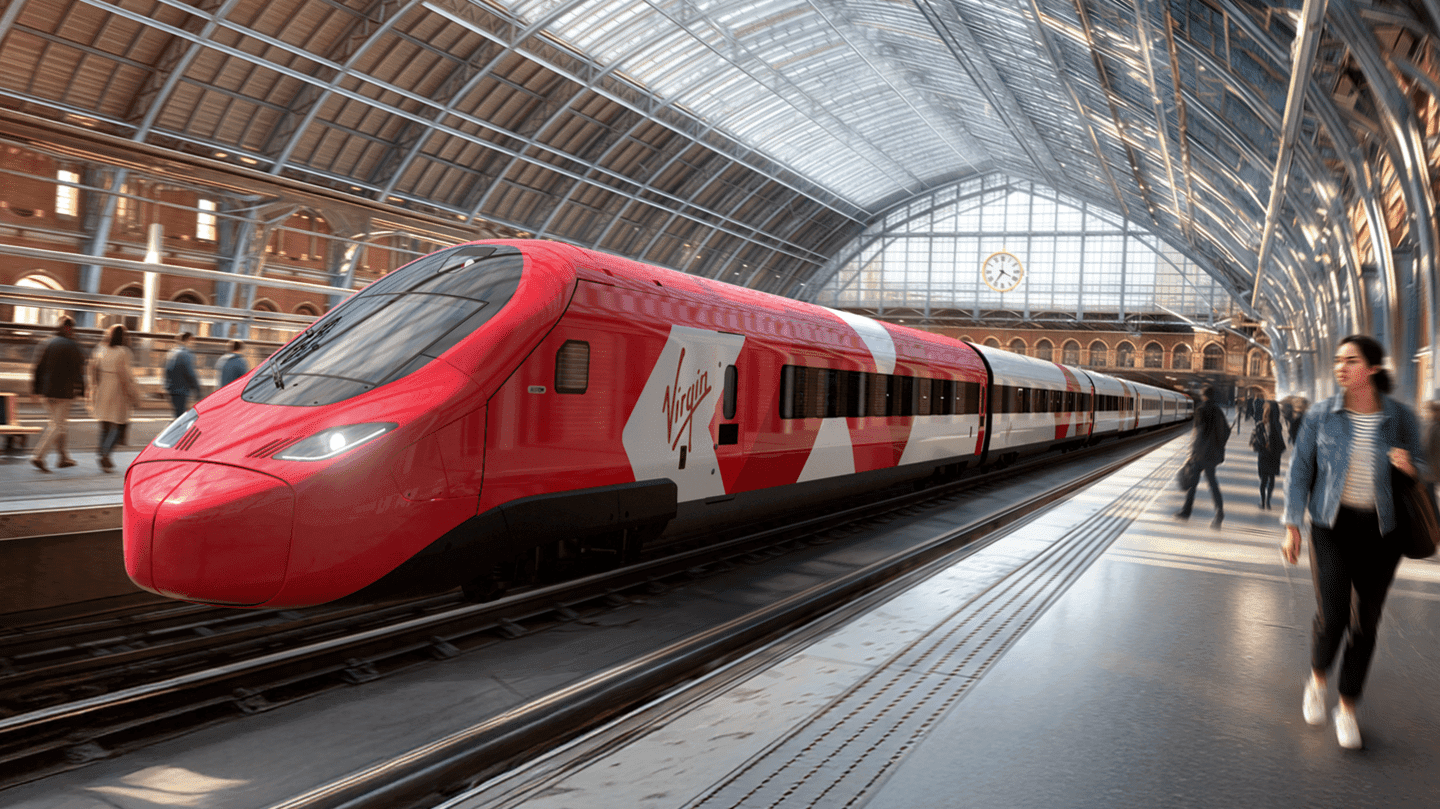

LONDON, UNITED KINGDOM – In a significant move poised to reshape European rail travel, the United Kingdom's Office of Rail and Road (ORR) on Thursday, October 30, 2025, approved an application from Sir Richard Branson's Virgin Trains to access a critical maintenance depot in East London. This decision is the most substantial step yet towards ending the 30-year monopoly held by Eurostar on passenger services through the Channel Tunnel, which has been in place since its inauguration in 1994. The approval unlocks a proposed £700 million investment, projected to create 400 new jobs and introduce competing services by 2030.

The ORR's ruling grants Virgin Trains access to the Temple Mills depot in Leyton, a site indispensable for any potential Eurostar competitor. Temple Mills is the only train depot in the UK with a direct connection to High Speed 1, the railway line linking London to the Channel Tunnel, that can service the larger continental European train models. Access to its light maintenance and storage facilities was deemed a critical requirement for launching a viable international service. The regulator concluded that Virgin's proposal was the most financially and operationally robust among several applicants, which included Evolyn, Gemini Trains, and Trenitalia.

Since its official opening on May 6, 1994, the Channel Tunnel has been the sole domain of Eurostar for passenger rail. This long-standing monopoly has faced criticism for contributing to high last-minute ticket prices compared to airlines. While the tunnel itself is reportedly used at only about 50% of its capacity, logistical and regulatory barriers have historically prevented new entrants. Sir Richard Branson, founder of the Virgin Group, celebrated the decision as a victory for consumers. "It's time to end this 30-year monopoly and bring some Virgin magic to the cross-Channel route," he stated on Thursday. "We're going to shake-up the cross-Channel route for good and give consumers the choice they deserve."

The introduction of competition is expected to drive down fares and improve service quality for millions of passengers travelling between London and continental hubs like Paris, Brussels, and Amsterdam. Virgin's plans are backed by infrastructure investor Equitix and private equity firm Azzurra Capital. The company has also reached an agreement with manufacturer Alstom to acquire a fleet of 12 new Avelia Stream trains.

However, the ORR's approval is just the first step. Virgin Trains must now secure a commercial agreement with Eurostar, which operates the depot, and gain a series of further regulatory approvals covering track access, station use, and safety certifications in both the UK and the European Union before services can commence.

This development in the UK occurs within a broader European context of railway market liberalisation, a process encouraged by the EU's 'Fourth Railway Package' to foster competition and create a single European rail area. Countries like Italy, Spain, and Sweden have already seen benefits from increased competition, including lower prices and more innovative services.

For Kenya and the wider East African region, this event serves as a potent case study on the economic impact of dismantling transportation monopolies. As Kenya continues to invest heavily in its own infrastructure, such as the Standard Gauge Railway (SGR), the UK's experience offers valuable insights into how regulatory frameworks can be used to encourage private investment and enhance consumer choice. The potential for lower travel costs in Europe is also a direct benefit for the Kenyan diaspora, business travellers, and tourists visiting the continent. The principles of fostering competition to drive down costs and improve services are universally applicable, providing a clear policy example for Kenya's transport, energy, and telecommunications sectors.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

Key figures and persons of interest featured in this article