We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Safaricom has moved one step further from being a payments rail to becoming a full-service financial platform, unveiling Ziidi Trader, a feature that allows M-PESA users to buy and sell shares listed on the Nairobi Securities Exchange (NSE) directly inside the app.

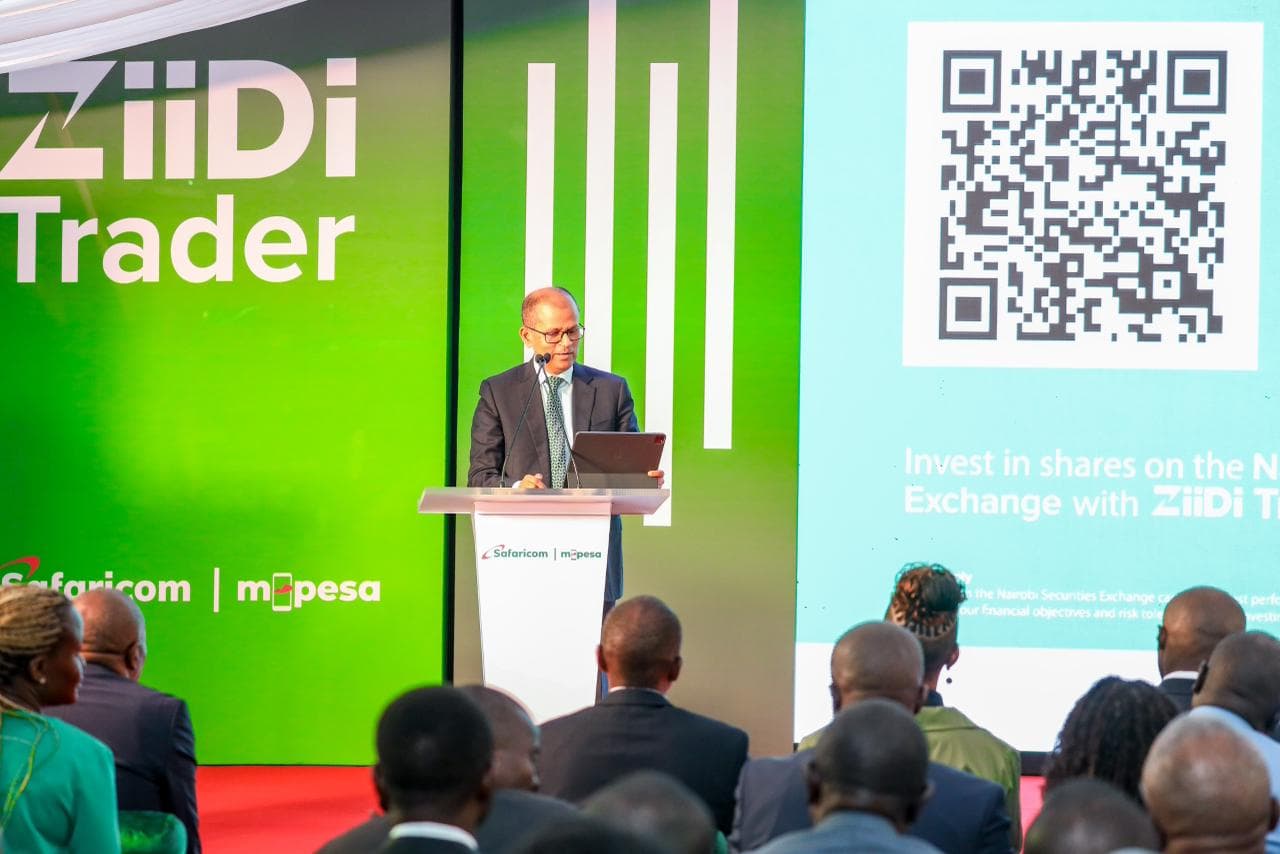

Safaricom has moved one step further from being a payments rail to becoming a full-service financial platform, unveiling Ziidi Trader, a feature that allows M-PESA users to buy and sell shares listed on the Nairobi Securities Exchange (NSE) directly inside the app. Reports from the NSE launch on Tuesday, February 10, 2026, frame the rollout as an attempt to bring capital markets closer to “ordinary Kenyans” by putting share trading where millions already keep money: their mobile wallet.

If it works, Ziidi Trader could become one of the most consequential financial-access plays Kenya has seen since mobile money went mainstream—because it targets the barrier that has quietly kept many would-be investors out: friction. For years, buying shares often meant choosing a broker, opening a Central Depository System (CDS) account, completing paperwork, and waiting. Ziidi Trader’s promise is to compress that journey into a familiar interface and a few taps.

Early reporting indicates Ziidi Trader is structured so that users do not need an individual CDS account at entry. Instead, funds from multiple investors are pooled into a single account managed by an investment firm (reported as Kestrel), with trades executed through that structure. The NSE sees this as a fast lane for retail participation—potentially “anonymous” and operationally simpler than the conventional route.

That design choice is the product’s headline innovation—and also the detail that the public deserves to understand clearly. Pooled structures can widen access, but they also raise practical questions about transparency (how holdings are recorded and proven), investor protections, fees, dispute resolution, and what happens when you want to transfer positions outside the pooled environment. Those issues are not red flags; they are due diligence questions that matter precisely because the product is aimed at mass adoption.

Pull quote: “The battle for inclusion has shifted from access to participation—and now, to ownership.”

Ziidi Trader is arriving after years of investment in the “plumbing” that makes digital finance possible: smartphones and coverage.

Safaricom’s Lipa Mdogo Mdogo device-financing programme has been widely reported to have crossed two million 4G smartphones sold since its launch—positioned as a practical bridge for customers who previously could not afford internet-capable devices.

On infrastructure, Safaricom’s own disclosures show broadband coverage moving steadily upward—its FY2024 annual report cites 4G population coverage at 96.3%, while FY2025 reporting highlights 98% 4G coverage in Kenya.

This matters because investing at scale is impossible if customers can’t reliably access data services—or if the experience breaks outside major towns. Ziidi Trader is, in many ways, a “now that access is solved, here’s the next layer” product.

Safaricom is making this move with a powerful advantage: scale. In its HY26 investor presentation (November 2025), the company reported 37.9 million 30-day active M-PESA customers—a user base large enough to reshape market behaviour if even a small fraction becomes regular investors.

Ziidi Trader also builds on Safaricom’s broader Ziidi brand in wealth products. Safaricom’s Ziidi Money Market Fund information pages describe an investment entry point starting at KES 100, with onboarding through M-PESA.

From a business perspective, analysts are already pointing out that Ziidi Trader could open new fee lines under Safaricom’s financial services—part of a longer-running shift away from relying mainly on person-to-person transfers.

This is where the community conversation must be sharper than hype. If share trading is about to be “mobile-first,” then consumer understanding has to rise with convenience.

Key questions for public awareness:

Fee clarity: What are the total costs per trade (and any custody/management fees), and how are they displayed before confirmation? (Because small fees, multiplied by frequent trading, can quietly erode returns.)

Ownership records: In a pooled account model, how exactly are individual holdings tracked, evidenced, and audited?

Liquidity and execution: How are orders matched—at what price, with what timing, and what happens during volatile market swings?

Investor protection: What is the dispute process, and which regulator/ombudsman handles complaints linked to pooled shareholding structures?

Risk education: Are users clearly warned that shares can fall in value and that “ease of buying” does not equal “safety”?

These are not theoretical concerns; they are the practical guardrails that determine whether inclusion becomes empowerment—or simply faster access to risk.

Kenya’s financial inclusion policy direction increasingly recognizes the role of digital channels and major providers like Safaricom’s M-PESA in widening access to financial services. The Kenya National Financial Inclusion Strategy (2025–2028) acknowledges established digital finance players as central to the ecosystem’s evolution. Ziidi Trader lands squarely in that national trajectory—moving the inclusion conversation from payments and savings toward capital market participation.

If you’ve never bought shares before: Ziidi Trader could remove traditional onboarding hurdles and let you start from a familiar tool—M-PESA.

If you already invest: Watch how the pooled model affects portability, statements, and how easily you can prove/transfer holdings if needed.

For the market: If adoption scales, NSE retail participation could deepen—while brokers and legacy onboarding models face pressure to evolve.

Ziidi Trader is a bold, high-impact idea: put investing where the people already are. Safaricom is betting that the next chapter of inclusion is not just being able to transact—but being able to own productive assets. The opportunity is real. So is the responsibility: the more friction you remove, the more important transparency, consumer education, and investor protections become.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Other hot threads

E-sports and Gaming Community in Kenya

Active 8 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 8 months ago

Popular Recreational Activities Across Counties

Active 8 months ago

Investing in Youth Sports Development Programs

Active 8 months ago