We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The Parliamentary Budget Office warns the government's Ksh 4.3 trillion budget for 2025/26 relies on overly optimistic revenue targets, risking deeper debt and painful austerity if missed.

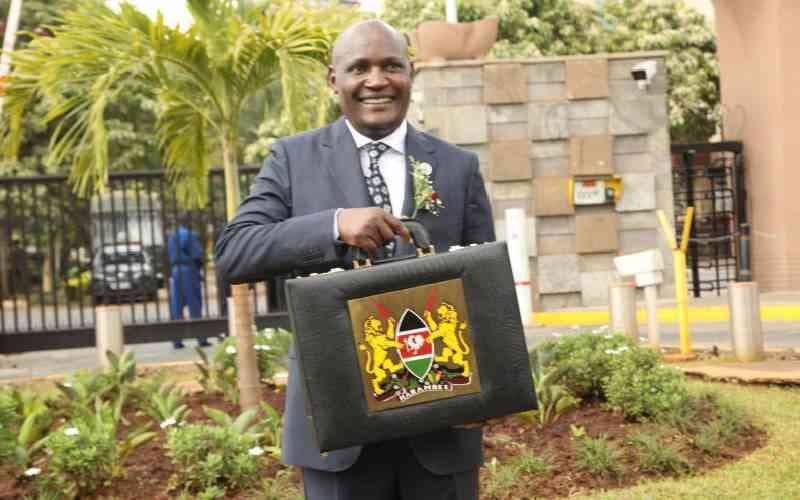

NAIROBI, KENYA – The Parliamentary Budget Office (PBO) has issued a stark warning over the credibility of the Kenya Kwanza administration's fiscal plans, flagging what it terms a “turbulent” and risky outlook driven by overly optimistic revenue projections for the 2025/2026 financial year. In its latest report, "Budget Options for FY 2025/2026 and the Medium Term," the legislative watchdog cautioned Members of Parliament to exercise extreme caution, highlighting a significant gap between the National Treasury's targets and more realistic collection capabilities.

The administration's Ksh 4.3 trillion budget projects total revenues, including grants, at approximately Ksh 3.4 trillion. This hinges on an ambitious ordinary revenue target of Ksh 2.8 trillion, a figure the PBO suggests may be unattainable given persistent collection shortfalls and a challenging economic environment. The fiscal landscape is characterized by significant debt service costs, which are projected to consume over Ksh 1.37 trillion, and immense pressure to fund social programs under the Bottom-Up Economic Transformation Agenda (BETA).

The PBO's analysis points to a consistent pattern of revenue underperformance. In the first half of the 2024/25 fiscal year, ordinary revenue collection reached only 44.1% of the annual target, signaling a struggle to meet projections. This trend raises serious questions about the Treasury's forecast for the upcoming fiscal year, which anticipates a 6.7% growth in ordinary revenue. Independent bodies like the Institute of Public Finance (IPF) have echoed these concerns, noting that the revision of revenue targets downwards in the recent past without corresponding expenditure cuts has widened the fiscal deficit and damaged policy credibility.

While the government's economic growth projection stands at a steady 5.3% for 2025, supported by a resilient agricultural sector and stable service industry, this optimism is not shared by all. The World Bank projects a more modest growth of 4.5% in 2025, citing challenges like high interest rates and policy uncertainty that constrain investment. This discrepancy in growth forecasts is central to the budget debate, as lower-than-expected economic activity would directly translate into lower tax receipts, further compounding the revenue shortfall.

A failure to meet the ambitious revenue targets poses severe consequences for the Kenyan public. The most immediate impact would be an increase in borrowing to plug the resulting fiscal deficit, which is already projected at Ksh 923.2 billion. This would be financed through Ksh 592 billion in domestic borrowing and Ksh 284 billion in external debt. Increased domestic borrowing often leads to higher interest rates, crowding out private sector investment and making credit more expensive for businesses and individuals.

Furthermore, a significant revenue gap could force the government into painful austerity measures. This could involve drastic budget cuts to essential services in health, education, and infrastructure, as well as delays in disbursing funds to county governments, thereby crippling services at the local level. Such cuts would undermine the core objectives of the BETA platform, potentially stalling critical development projects and social safety net programs designed to support low-income households.

Kenya's public debt remains a major concern, standing at Ksh 11.5 trillion as of May 2025, with a debt-to-GDP ratio of 67.4%—well above the IMF's recommended threshold of 50% for developing nations. Interest payments alone are consuming about a third of all tax revenue, a figure the World Bank has flagged as a high risk to debt sustainability. Any further increase in borrowing would exacerbate this precarious situation, diverting more public funds away from development and towards debt servicing.

The National Treasury, in its 2025 Budget Policy Statement, maintains that its fiscal consolidation plan is on track. It defends its revenue targets by pointing to planned tax administration reforms, including the full implementation of the Electronic Tax Invoice Management System (eTIMS) and leveraging technology to expand the tax base. The government's strategy is to enhance collection efficiency without introducing major new taxes, a shift from previous, more contentious Finance Bills.

However, critics argue that these administrative measures may not be sufficient to generate the required revenue leap in the short term. As Parliament prepares to debate and approve the 2025/26 budget estimates, it faces a critical decision. It must weigh the administration's ambitious development agenda against the fiscal realities presented by its own budget experts. The outcome of this process will have profound implications for Kenya's economic stability, the cost of living for its citizens, and the government's ability to deliver on its promises for the remainder of its term.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago