We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Kenyan lawmakers criticised a proposed sale of nearly a third of East Africa Portland Cement’s shares to Kalahari Cement, arguing that the secretive transaction lacks transparency and threatens jobs and public investment.

Nairobi, Kenya — 2025-09-17 13:15 EAT. Parliament’s Trade, Industry and Cooperatives Committee has demanded answers over plans to sell nearly a third of East Africa Portland Cement (EAPC) authorised shares to Kalahari Cement, citing lack of transparency and potential job losses.

Deal scope: Proposed transfer of 29.2% of authorised shares.

Impact: Kalahari would hold 41.7%; government retains 52.3% via NSSF and the National Treasury.

Status: MPs insist on public participation before any transfer proceeds.

Transaction allegedly conducted in the company secretary’s office without management, employee, or community input.

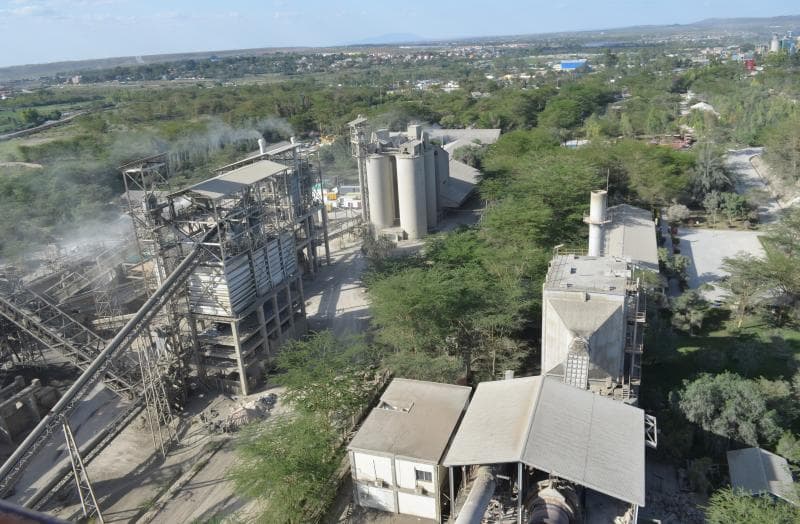

EAPC, historically government-controlled, owns major quarrying operations employing hundreds across Machakos and Kajiado.

Public Participation Act (2018): Requires consultation on significant state-related transactions.

Companies Act (2015): Mandates shareholder and regulatory approvals for major ownership changes.

Parliamentary oversight: MPs plan further hearings before the Trade Committee.

Marianne Kitany, Aldai MP: “Kenyans own this firm through pensions and taxes. Due diligence and community consultation are not optional.”

Mohammed Adan, EAPC MD: Warned the sale could trigger job losses if not carefully structured.

Wilberforce Oundo, Funyula MP: Urged against decisions that harm quarrying livelihoods.

Stakeholders: Government (52.3%), Kalahari Cement (proposed 41.7%), private investors (remaining stake).

Share sale size: 29.2% authorised shares under review.

Location impact: Machakos, Kajiado communities reliant on EAPC quarries.

Employment: Potential retrenchments if Kalahari restructures operations.

Transparency: Deal secrecy could trigger legal or parliamentary blockages.

Public assets: Risk of undervaluation without open tender or share buyback.

Whether NSE listing rules were followed.

Valuation methods for the 29.2% stake.

Kalahari’s post-acquisition investment commitments.

Pre-Sept 2025: Transaction initiated internally.

2025-09-17: MPs raise alarm, demand hearings.

Pending: Committee scrutiny before share transfer approval.

Parliamentary hearings on due diligence and valuation.

Possible share buyback proposal by EAPC or Treasury.

Community consultations in Machakos, Kajiado counties.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

Key figures and persons of interest featured in this article