We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Nyando MP Caroli Omondi has warned that the government’s plan to borrow Ksh480 billion locally will crowd out private borrowers, raise interest rates and stifle small businesses

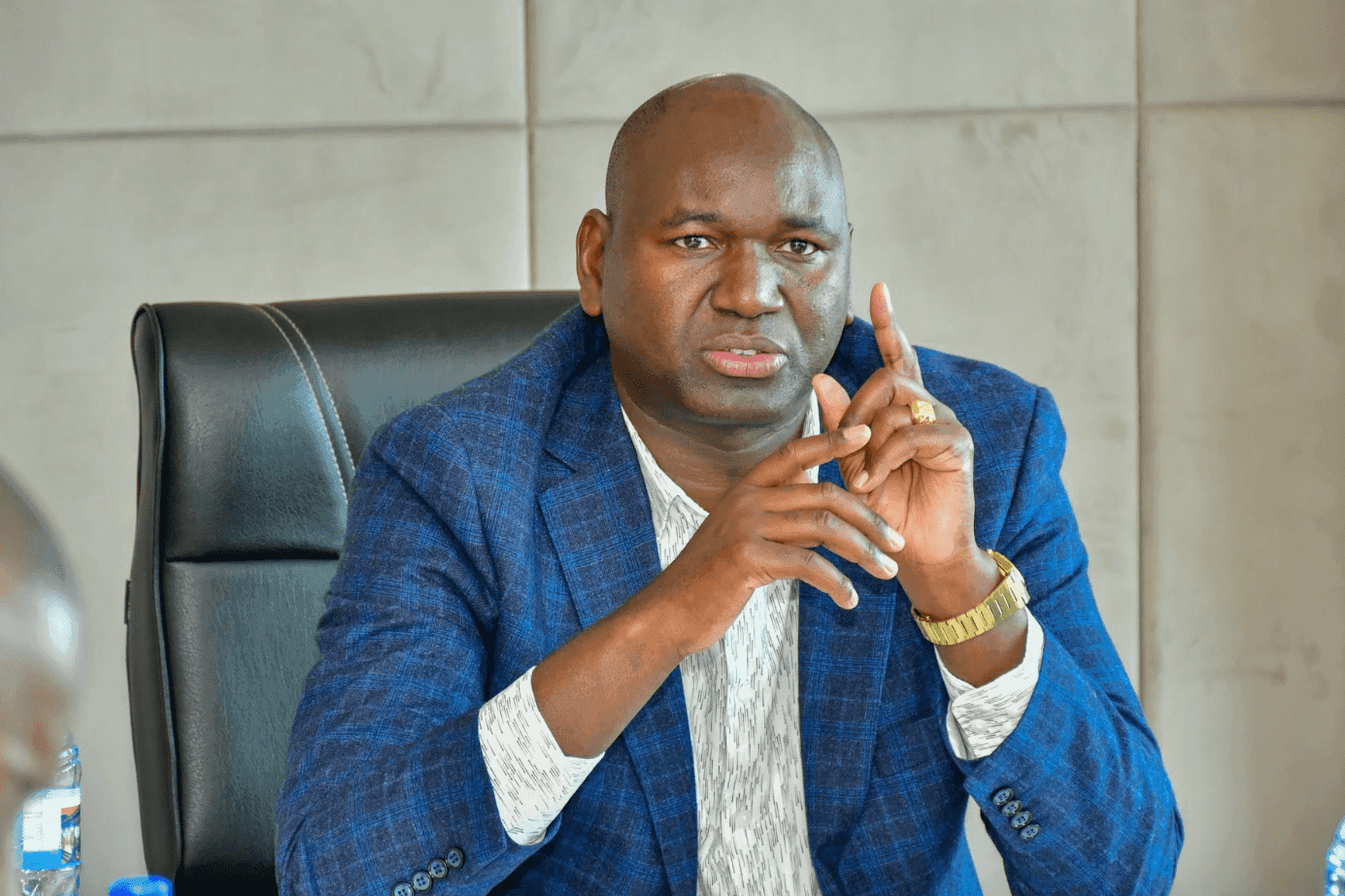

Nairobi, Kenya – Nyando Member of Parliament Caroli Omondi has cautioned that the government’s plan to borrow Ksh480 billion from the domestic market could squeeze out private borrowers and slow down economic growth. Speaking during a constituency event on 18 August, Omondi said commercial banks would prioritise lending to the state at higher interest rates, leaving small businesses and consumers with limited access to credit.

Omondi argued that heavy domestic borrowing is unsustainable and urged the Treasury to explore cheaper external financing or restructure expenditure instead of crowding out the private sector. He said many Kenyans are already struggling with high interest rates on personal and business loans and that greater government demand for credit will push rates even higher. The lawmaker called on Parliament to scrutinise the borrowing plan and to require the Treasury to provide a detailed debt‑management strategy.

The MP suggested that instead of borrowing, the government should operationalise the proposed Youth Enterprise Investment Bank, which President William Ruto announced in June. The bank would provide affordable loans and training to young entrepreneurs, helping them start and expand businesses. Omondi argued that such targeted interventions are more effective at stimulating growth than sweeping borrowing programmes.

Economists note that Kenya has increasingly relied on domestic debt as access to international markets tightened amid global economic uncertainty. While domestic borrowing is often faster to arrange, it can crowd out private investment if not carefully managed. The Central Bank of Kenya has indicated that it will monitor liquidity conditions to ensure that credit to the private sector remains available.

As the government prepares to table its borrowing plan in Parliament, public finance watchdogs have demanded transparency and fiscal discipline. They caution that failure to manage the debt burden could derail development programmes and erode confidence in Kenya’s economy.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

Key figures and persons of interest featured in this article