We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The Hague has taken over Nexperia, a critical semiconductor manufacturer, citing governance issues and the need to secure Europe's chip supply, a move with potential ripple effects on global technology supply chains, including those impacting Kenya's burgeoning tech sector.

The Dutch government has taken control of Nexperia, a Netherlands-based chipmaker owned by China's Wingtech Technology, in a highly unusual intervention aimed at safeguarding Europe's semiconductor supply and economic security. The decision, announced on Monday, October 13, 2025, by the Dutch Ministry of Economic Affairs, was made under the country's Goods Availability Act, citing "serious governance shortcomings" at Nexperia.

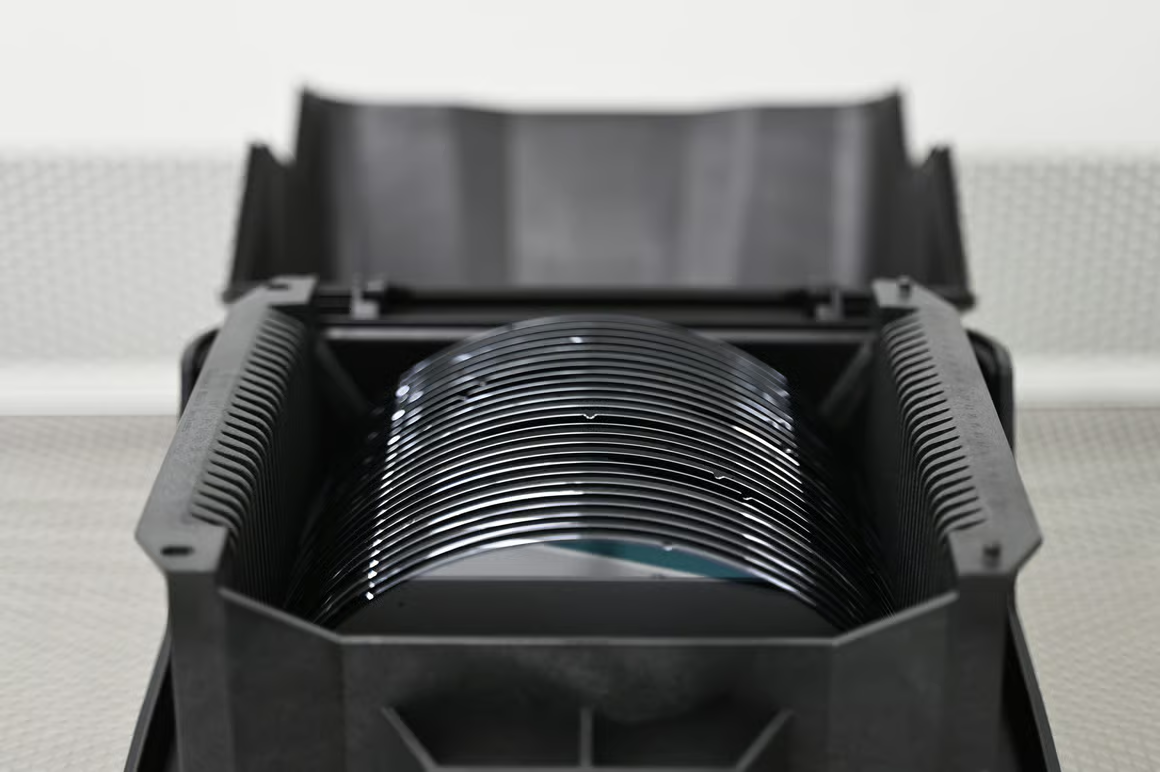

This move allows the Dutch government to block or reverse managerial decisions at Nexperia if they are deemed harmful to the company's interests, its future as a Dutch and European enterprise, or the preservation of this critical value chain for Europe. Nexperia is a significant producer of chips for the automotive and electronics industries, shipping over 100 billion units annually.

Nexperia, headquartered in Nijmegen, Netherlands, was originally the Standard Products business unit of Dutch healthtech company Philips. It was acquired by Chinese electronics manufacturer Wingtech Technology in 2018 for approximately $3.63 billion. Wingtech is partially owned by the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) of China.

This takeover is the latest development in escalating global tensions surrounding access to high-end technology, particularly semiconductors. The European Union has been working to boost its digital sovereignty and strengthen its semiconductor supply chain, with initiatives like the EU Chips Act aiming to increase Europe's share in global semiconductor production to 20%.

Previous actions related to Nexperia include the US government adding Wingtech to its Entity List in 2024 due to national security concerns, and the UK government ordering Wingtech-owned Nexperia to divest its acquisition of Newport Wafer Fab in 2022, also citing national security risks.

The Dutch government's intervention marks the first time the Goods Availability Act has been invoked. The Ministry of Economic Affairs stated that the decision was prompted by "recent and acute signals of serious governance shortcomings" at Nexperia, which posed a threat to maintaining crucial technological knowledge and capabilities on Dutch and European soil.

Wingtech, Nexperia's parent company, has stated it will take action to protect its rights and seek government support. In a now-deleted WeChat post, Wingtech reportedly criticized the Dutch government's decision as "excessive intervention driven by geopolitical bias, rather than a fact-based risk assessment."

Analysts suggest this development could significantly influence public debate and policy execution regarding technology sovereignty and supply chain resilience. Stakeholders are urging clarity on timelines, costs, and safeguards. Nexperia, in a statement to news publications, affirmed its compliance with all existing laws, regulations, export controls, and sanctions regimes, and its regular contact with relevant authorities.

While the immediate impact is on Europe, such geopolitical actions in the semiconductor industry have global ramifications. Kenya, which is actively developing its own semiconductor industry, could face both challenges and opportunities. Global chip shortages, exacerbated by geopolitical tensions, have previously led to delays in the production and importation of electronic devices in Kenya, affecting consumers and businesses reliant on these imports.

However, this global focus on diversifying semiconductor supply chains could also benefit Kenya. The country is positioning itself as a key player in Africa's semiconductor ecosystem, with initiatives like the Konza Technopolis, also known as "Africa's Silicon Savannah." Kenya is the premier semiconductor manufacturer in Africa and possesses a third of the critical minerals necessary for semiconductor production.

Recent partnerships, such as the US Trade and Development Agency's commitment of $1.3 million to support Kenya-based Semiconductor Technologies Limited (STL), aim to expand chip fabrication on a commercial scale in Kenya. This aligns with Kenya's Vision 2030 and the UN's Agenda 2030, reinforcing the country's commitment to sustainable development through industrial transformation.

The long-term implications of the Dutch government's control over Nexperia remain uncertain. Wingtech's planned legal actions and calls for government support could lead to further diplomatic and trade disputes between China and European nations. The specific "governance shortcomings" cited by the Dutch government have not been fully elaborated.

The Dutch government's intervention took effect on Monday, October 13, 2025. Wingtech has indicated it will pursue legal remedies. The broader debate within Europe on strengthening its semiconductor capabilities is ongoing, with calls for a "Chips Act 2.0" to extend beyond manufacturing to include chip design, materials, and equipment.

Observers will be watching for Wingtech's next steps, including any legal challenges or appeals to the Chinese government for intervention. The response from other European nations and the wider international community to this unprecedented government takeover will also be crucial. For Kenya, the focus will be on how global supply chain shifts create opportunities for increased investment and partnerships in its nascent semiconductor industry.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago