We're loading the full news article for you. This includes the article content, images, author information, and related articles.

President Xi Jinping's focus on technological self-reliance and domestic prosperity in the upcoming 15th Five-Year Plan is set to reshape trade, infrastructure financing, and digital development across East Africa.

BEIJING, China – President Xi Jinping has outlined the core priorities for China's 15th Five-Year Plan (2026-2030), signalling a strategic pivot towards greater technological self-reliance, a modernized industrial system, and domestic economic resilience. The directives, announced following a symposium in Beijing, according to a press statement released on Friday, October 24, 2025 (EAT), are designed to steer the world's second-largest economy towards its goal of achieving “socialist modernization” by 2035, regardless of external pressures.

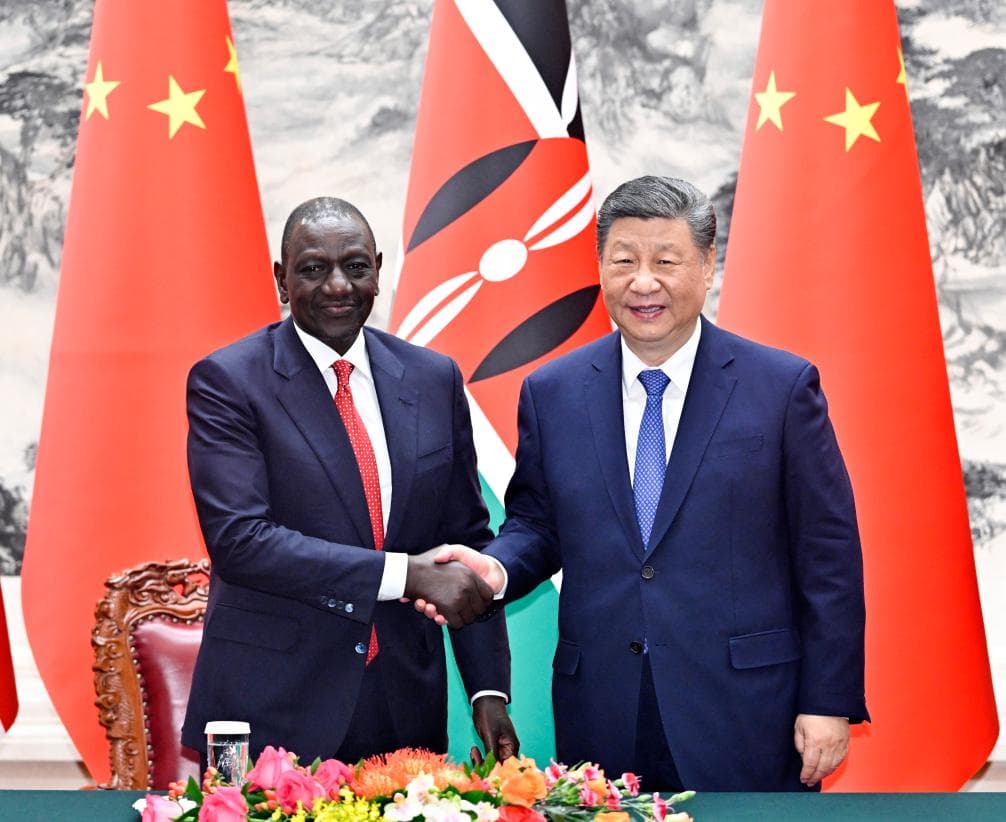

While the plan is internally focused, its implications are profound for key economic partners, including Kenya. As Kenya's largest bilateral creditor and a dominant trading partner, China's strategic shifts in industrial policy, technology, and finance are expected to create significant ripples in Nairobi, affecting everything from infrastructure loans to the country's manufacturing ambitions.

A central theme of the new plan is achieving greater self-reliance in critical technologies like semiconductors, artificial intelligence, and green energy. This ambition is a direct response to escalating technology restrictions from the United States and aims to reduce China's dependence on foreign suppliers. For Kenya, this policy could reshape the landscape of digital infrastructure development. Chinese technology giants like Huawei and ZTE have been instrumental in building out Africa's 4G and 5G networks. A heightened focus on homegrown technology may lead to a more aggressive promotion of Chinese technical standards and could alter the terms of technology transfer agreements that are often part of bilateral deals.

This drive for tech independence also presents a challenge for Kenya's own aspirations for digital sovereignty and cybersecurity, making diversification of technology partners a more critical strategic consideration for Nairobi.

The plan also calls for accelerating the development of a “modernized industrial system,” which involves China moving up the global value chain and focusing on high-tech manufacturing. This shift has dual implications for Kenya's manufacturing sector, a key pillar of the country's Vision 2030 economic blueprint.

On one hand, it could intensify competition. An influx of sophisticated and potentially cheaper Chinese goods could pose a threat to nascent Kenyan industries. Trade data consistently shows a significant imbalance, with China's exports to Kenya far outweighing its imports. According to the General Administration of Customs of China, the cumulative trade value between the two nations from January to April 2025 was approximately $3.23 billion, with Chinese exports to Kenya accounting for $3.15 billion. On the other hand, as Chinese firms vacate lower-end manufacturing, it could create an opportunity for Kenyan companies to fill the void, particularly in sectors like textiles and light assembly. However, seizing this opportunity would require significant improvements in local competitiveness, logistics, and energy costs.

President Xi's emphasis on “common prosperity” and expanding domestic demand signals a potential recalibration of China's overseas investment strategy. Analysts will be closely watching whether this internal focus leads to more cautious lending for large-scale infrastructure projects under the Belt and Road Initiative (BRI), which has funded landmark Kenyan projects like the Standard Gauge Railway (SGR). China remains Kenya's largest bilateral creditor, with debt service costs for the financial year ending June 30, 2025, amounting to Sh129.35 billion. Kenya's total public debt stood at a record KSh 11.51 trillion as of May 2025.

Recent trends suggest a shift in Chinese financing from massive infrastructure loans toward more targeted industrial projects. In September 2025, Kenya's Treasury confirmed that advanced talks were underway to restructure its dollar-denominated loans from China into Chinese Yuan, a move that could potentially halve interest rates and provide fiscal relief. This aligns with a broader trend of Chinese engagement through frameworks like the Forum on China-Africa Cooperation (FOCAC), which increasingly prioritizes industrialization, agricultural modernization, and green development. As China's new five-year plan takes shape, Kenyan policymakers will need to adapt to this evolving financial landscape, seeking partnerships that align with Nairobi's debt sustainability goals and economic priorities.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago