We're loading the full news article for you. This includes the article content, images, author information, and related articles.

In a week defined by renewed investor appetite for industrial goods and financial resilience, three Nigerian heavyweights—Access Holdings, AIICO Insurance, and Transcorp—have emerged as the definitive "Buys" for the discerning African portfolio.

In a week defined by renewed investor appetite for industrial goods and financial resilience, three Nigerian heavyweights—Access Holdings, AIICO Insurance, and Transcorp—have emerged as the definitive "Buys" for the discerning African portfolio.

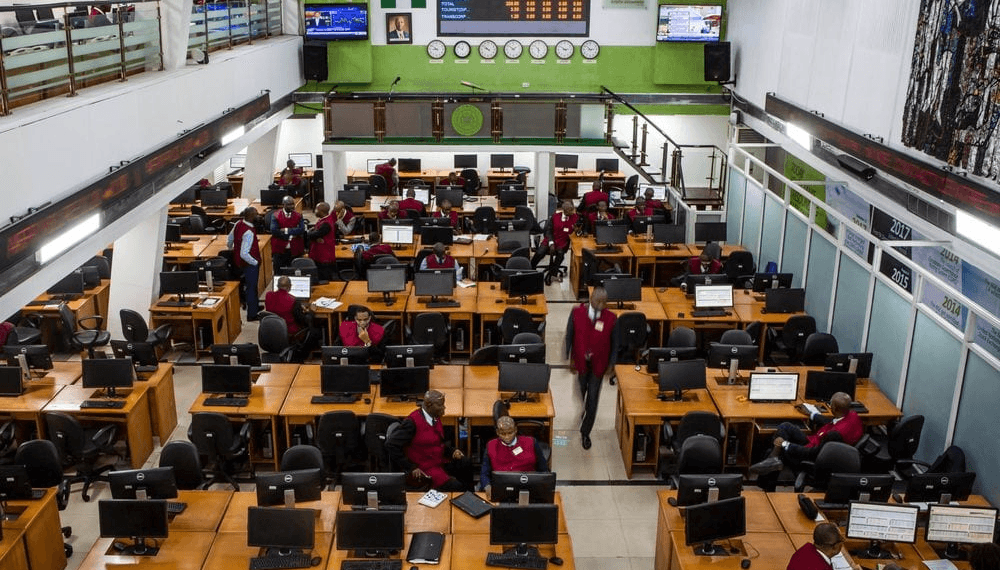

The West African equity markets are currently staging a fascinating resurgence. As Nairobi battles its own fiscal headwinds, the Lagos floor is telling a story of undervaluation and latent potential that East African investors would be wise to scrutinize. The latest data from Meristem Securities does not just highlight stock picks; it reveals a structural shift in where smart money is flowing in 2026.

The headline story is Access Holdings. For months, the banking giant has been trading with a deceptive quietness, but the fundamentals scream of a breakout. With a Net Profit Ratio (NPR) of 13.8% and a Price-to-Earnings (PE) ratio sitting at a criminal 1.8x, the stock is arguably one of the most undervalued banking assets on the continent. In a sector where average PEs often hover between 4x and 6x, Access is trading at a discount that defies logic, likely driven by broader macro-fears that savvy contrarians are now exploiting. Its Relative Strength Index (RSI) of 71.8 suggests momentum is already building—this is not a "wait and see" stock; it is a "move now" asset.

While banking takes the volume, the real story of efficiency is found in Transcorp. [...](asc_slot://start-slot-5)The conglomerate has posted a staggering Net Profit Ratio of 22.2%. To put this in perspective (approx. KES context), for every 100 shillings of revenue, Transcorp is keeping 22 as pure profit—a margin that manufacturing and hospitality firms rarely achieve in this inflationary era. Trading at a PE of 8.4x, it balances growth with value.

Then there is the insurance underdog, AIICO. Insurance in Africa is often a volume game with razor-thin margins, yet AIICO has secured an NPR of 8.1%. With an RSI of 52.6, it sits in the "Goldilocks" zone—neither overbought nor oversold. It represents the steady, defensive play in a volatile market.

Why should a Nairobi investor care about Lagos tickers? Because the correlation between these markets is decoupling. As the shilling stabilizes, diversifying into naira-denominated assets—specifically those with strong export-based revenues or massive domestic moats like Transcorp—provides a hedge against regional volatility.

The "West African Giants" are waking up. The window to acquire these assets at single-digit PE ratios is closing, and history suggests that when the correction comes, it will be swift and vertical.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago