We're loading the complete profile of this person of interest including their biography, achievements, and contributions.

Founder, Copia Kenya

Public Views

Experience

Documented career positions

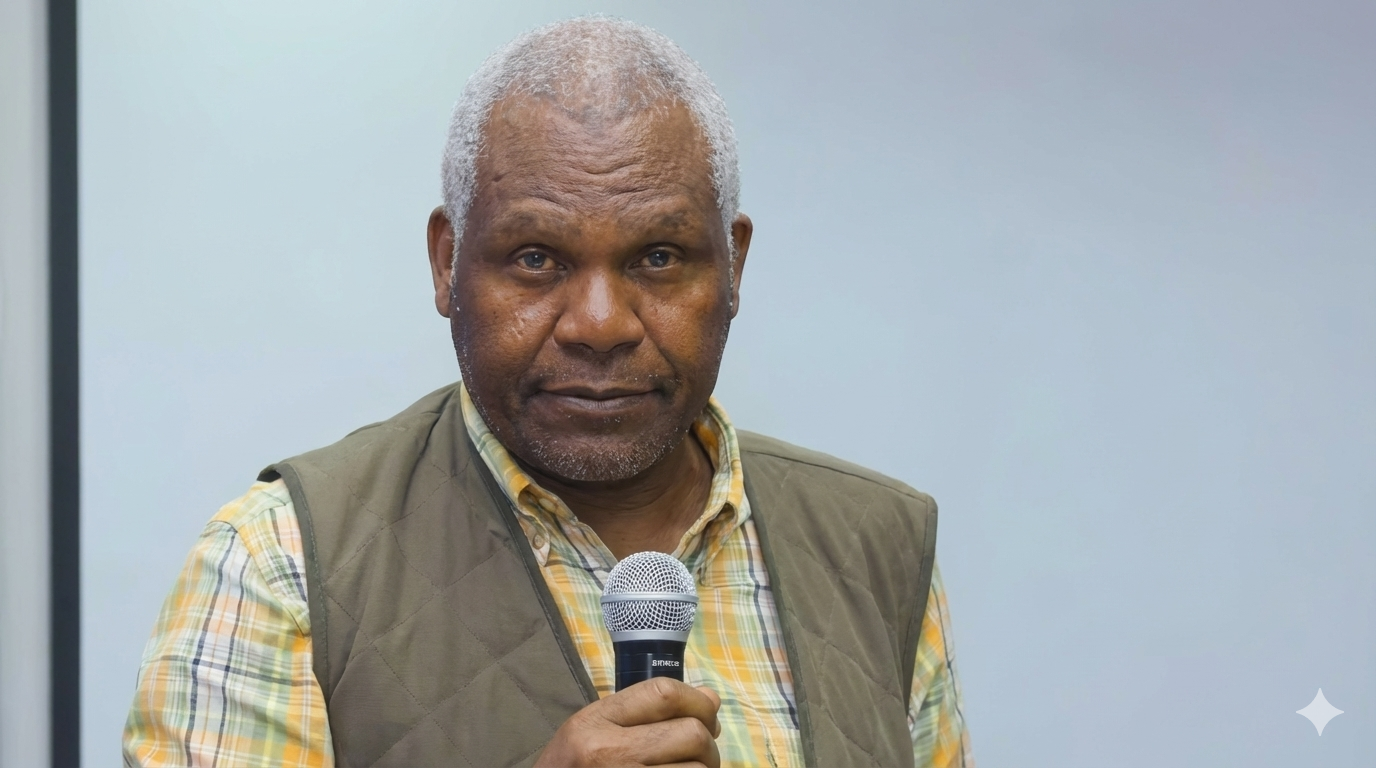

Pius Ngugi Mbugua, born on 8 March 1944 in Kiambu County, Kenya, is a long-standing entrepreneur whose business trajectory has spanned agriculture, food processing, insurance and real estate. He is the founder of Kenya Nut Company (established in the 1970s), which has grown into one of Kenya’s major macadamia and cashew nut processors and exporters, and which by 2016 was reported to generate KSh 6 billion in revenue. He is also the proprietor of Thika Coffee Mills, a prominent milling and export business in Kenya’s coffee value-chain, and holds shareholdings in the insurance sector (via Kenya Alliance Insurance) and other agribusiness ventures including dairy and winery. Drawing from his roots in Kenya’s rural economy, Ngugi has built a diversified portfolio that anchors processing capacity on local agricultural production while engaging with formal manufacturing, export logistics and capital-intensive real estate investment. In the real estate and development arena, Pius Ngugi extended his influence by joining the shareholder cadre of the large-scale special economic zone project Tatu City – a mixed-use development located some 18 km outside central Nairobi, envisioned as a live-work-play hub for 100,000 residents. His business footprint illustrates a strategic blend of primary-sector value creation and secondary/tertiary-sector stakeholding, positioning him as both a farmer-industrialist and real-estate developer. With his role as a prominent figure in the Kenyan business community, Ngugi’s story exemplifies how agrarian enterprise can scale into diversified investment across sectors, and how rural production linkages can feed into global value chains and domestic real-estate growth.

He founded and built the Kenya Nut Company (est. 1974) into one of Kenya’s largest nut-processing and export enterprises, employing thousands and generating significant export revenue.

Through ownership of Thika Coffee Mills, he contributed to the coffee value chain in Kenya—processing, grading and exporting speciality coffee.

He invested in large-scale real-estate and infrastructure development as a shareholder in Tatu City, a major mixed-use development project near Nairobi designed for tens of thousands of residents and workers.

Britam Mauritius share deal investigation: A 2017–2018 Mauritius Commission of Inquiry examined the complex purchase of Britam shares involving Munga and partners, highlighting offshore structures and boardroom manoeuvres; while politically sensitive, it was framed as a regulatory and corporate-governance review rather than a criminal conviction.

Land disputes around Pioneer schools: He has been involved in high-profile land disputes, including court orders directing relocation or eviction of Pioneer International School from contested land involving Del Monte and other parties—cases that drew public attention to how elite educational institutions acquire land.

He diversified into multiple sectors (insurance via Kenya Alliance Insurance, dairy farming, winery, sweets manufacturing and motor vehicles) thereby broadening his business footprint across agriculture-processing, financial services and manufacturing.

Debt and collateral battles over Britam shares: Court records and media reports describe disputes where banks sought to auction substantial blocks of his Britam shares used as collateral, with some injunctions granted and later lifted—episodes that spotlighted the leverage and risk behind parts of his investment portfolio.

Ongoing scrutiny of wealth and influence: As a billionaire with deep stakes in finance, land and industry, Munga faces periodic scrutiny from activists and commentators on questions of inequality, land ownership and corporate power, even as many policymakers publicly praise his role in expanding access to finance.