We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The era of opaque bank loan pricing is over. A new benchmark, KESONIA, now dictates borrowing costs, promising transparency but demanding greater financial discipline from every Kenyan.

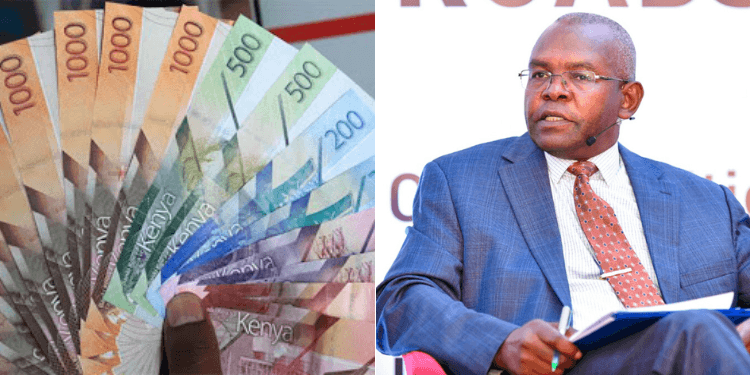

A fundamental shift in how banks price their loans is now in full effect, directly impacting the cost of credit for millions of Kenyans. As of December 1, 2025, all new variable-rate loans are being pegged to a new benchmark, the Kenya Shilling Overnight Interbank Average, or KESONIA, marking one of the most significant overhauls of the nation's credit market in recent years.

This is not just financial jargon; it's a change that reaches into the wallets of families and the balance sheets of businesses. The new system, mandated by the Central Bank of Kenya (CBK), is designed to make borrowing fairer and more transparent. It ends an era where loan rates were often loosely tied to the Central Bank Rate (CBR), a practice that led to public frustration when cuts in the policy rate failed to translate into cheaper loans for consumers.

Under the new framework, your interest rate is no longer a mystery. It is built using a simple, clear formula: the KESONIA rate plus a premium based on your individual risk profile. KESONIA itself is the average interest rate at which commercial banks lend to each other overnight, making it a true reflection of the day-to-day cost of money in the banking system.

The Central Bank, as the administrator, calculates and publishes this rate daily by 9:00 a.m., ensuring it is based on actual, verifiable transactions from the previous day. This transparency is a stark contrast to previous models where each bank used its own internal benchmarks. The total lending rate will be this new base rate plus a premium, which covers the bank's costs and the borrower's specific risk.

This new reality presents both an opportunity and a challenge for the Kenyan borrower. The core promise is fairness: your financial discipline now directly translates into the price of your loan.

The CBK has emphasized that this model will expand credit access to groups often left behind, such as Micro, Small, and Medium Enterprises (MSMEs), youth, and women-led businesses, by allowing banks to price risk more accurately.

The rollout is being staged to minimize disruption. While the directive took effect on September 1, 2025, many banks were given a three-month grace period to update their systems. The critical dates for every borrower to know are:

Fixed-rate loans and those denominated in foreign currency are not affected by this change. In situations where using KESONIA is not practical, the CBR will serve as a fallback, a detail that must be included in loan agreements.

CBK Governor Kamau Thugge explained the flexibility of the new model, noting, “If you have a very good customer and not very much risk... you can decide to say your loan will be KESONIA minus 1 or minus 2. If it's a very high-risk borrower, it will be KESONIA plus three or plus four.” This shift aligns Kenya with international best practices, mirroring benchmarks like SONIA in the UK and SOFR in the United States.

Ultimately, the move to KESONIA places the power of a good credit score directly into the hands of the consumer. As the financial landscape adapts, the message from the regulator is clear: in this new era of lending, your reputation is your most valuable asset.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago