We're loading the full news article for you. This includes the article content, images, author information, and related articles.

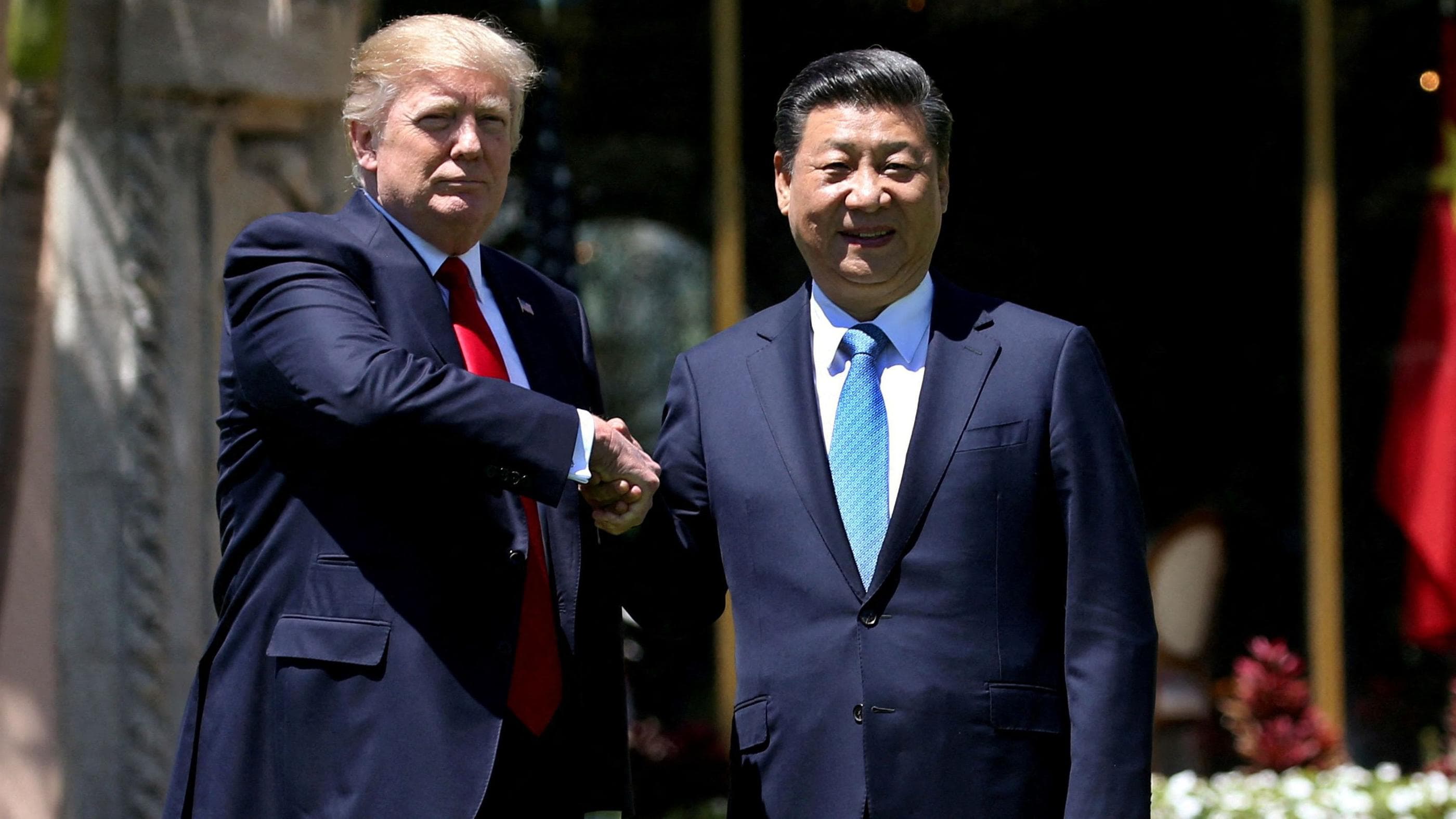

The tentative deal, set to be finalized by Presidents Trump and Xi, could stabilize global markets, offering potential relief for Kenyan exporters and easing uncertainty around key infrastructure projects.

The United States and China have reached a preliminary framework for a trade agreement, a move that averts the immediate threat of a significant escalation in their protracted trade war. The consensus was forged during two days of high-level talks in Kuala Lumpur, Malaysia, on the sidelines of the Association of Southeast Asian Nations (ASEAN) summit, which concluded on Sunday, October 26, 2025. The agreement effectively shelves President Donald Trump's plan to impose 100% tariffs on Chinese imports, which were slated to take effect on Friday, November 1, 2025.

U.S. Treasury Secretary Scott Bessent, who led the American delegation, announced the development, stating the talks had produced a “very substantial framework.” Speaking to U.S. media outlets, Bessent expressed confidence that the threat of the 100% tariffs “has gone away.” His Chinese counterpart, top trade negotiator Li Chenggang, confirmed that a “preliminary consensus” had been reached after “very intense consultations.” The framework is expected to be finalized during a face-to-face meeting between President Trump and Chinese President Xi Jinping scheduled for Thursday, October 30, 2025, in South Korea, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit.

The tentative deal involves significant concessions from both sides. China has reportedly agreed to delay its planned export controls on rare earth minerals for one year, pending a review. These minerals are critical for a wide range of technologies, including smartphones, electric vehicles, and advanced military hardware, and the threatened restrictions had caused global supply chain anxieties. In return, the U.S. has stepped back from the tariff threat that was a direct response to these planned export curbs.

A central component of the framework is a commitment from Beijing to make “substantial” purchases of U.S. agricultural products, particularly soybeans. This move is a significant relief for American farmers, who have been heavily impacted since China, previously their largest customer, halted most purchases. The agreement is also expected to extend the existing tariff truce, which was set to expire on November 10, 2025. Additionally, the talks addressed the trafficking of fentanyl, with China agreeing to help curb the flow of precursor chemicals.

The framework also includes a path to finalize the sale of the U.S. operations of the popular social media app TikTok. Bessent confirmed that a “final deal” on TikTok has been ironed out and will be formally consummated by the two presidents in South Korea. The deal involves the creation of a U.S.-based joint venture with a majority of American investors to address national security concerns.

While the negotiations are distant, their outcome carries significant weight for the Kenyan and broader East African economies. The de-escalation of the U.S.-China trade war brings a measure of stability to the global economy, which can positively impact Kenya. A prolonged trade war often leads to reduced global demand and disrupts supply chains, affecting Kenyan exports. The uncertainty has also been linked to a slowdown in foreign direct investment (FDI) in developing regions.

China is a primary source of financing for major infrastructure projects in Kenya and across the region. An economic slowdown in China, exacerbated by a trade war, could further constrain its ability to fund these projects, which have already seen a decline in recent years. A more stable trade environment could therefore support the continuation of these crucial development initiatives.

Furthermore, the trade tensions have implications for agreements like the African Growth and Opportunity Act (AGOA), which provides Kenyan exporters, particularly in the textile and apparel sectors, with tariff-free access to the U.S. market. An aggressive U.S. tariff posture globally creates uncertainty for such preferential trade agreements. A truce could preserve the stability of AGOA, safeguarding thousands of Kenyan jobs. However, analysts caution that East African nations must continue to diversify their trade partnerships, including strengthening ties within the African Continental Free Trade Area (AfCFTA) and with other blocs like the European Union, to mitigate risks from over-reliance on either superpower.

The path forward depends on the final agreement hammered out by Presidents Trump and Xi. While Chinese officials have been more reserved in their public statements, President Trump expressed optimism upon his arrival in Malaysia, telling reporters, “I think we’re going to have a deal with China.” The upcoming summit in South Korea will be closely watched in Nairobi and other regional capitals for signs of a lasting economic détente.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago