We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The apex court overturns a 2020 decision that classified interchange and network fees as royalties, shielding lenders from massive retroactive tax bills.

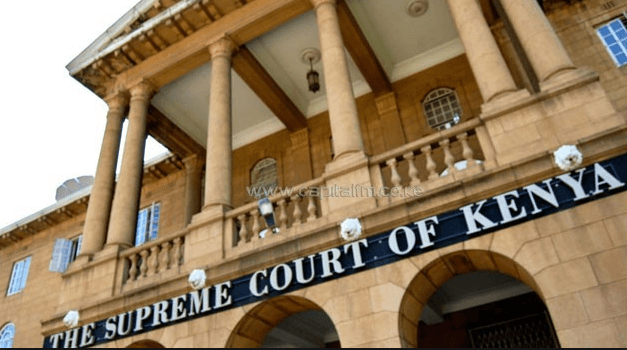

A dark cloud of retroactive tax liability hanging over Kenya’s banking sector has lifted after the Supreme Court unanimously overturned a contentious 2020 ruling. The decision marks the end of a high-stakes legal battle between Absa Bank Kenya and the taxman, effectively ruling that the cost of doing business should not be confused with taxable income.

At the heart of the dispute was a push by the Kenya Revenue Authority (KRA) to classify standard transaction fees as royalties and professional fees, a move that would have significantly increased the tax burden on lenders—costs that would inevitably have trickled down to the ordinary Kenyan depositor.

The saga began when the KRA’s Large Taxpayers Office demanded withholding tax on payments Absa made to international card networks like Visa and Mastercard, as well as interchange fees paid to other banks. In 2020, the Court of Appeal sided with the taxman.

That appellate ruling created a dangerous precedent for the industry. It categorized payments to global card networks as “royalties” and interchange fees—payments made between banks to settle transactions—as “management or professional fees.”

Had this interpretation stood, banks would have been liable for withholding tax on these operational transfers, potentially costing the sector billions of shillings in back taxes.

In its final verdict, the Supreme Court dismantled the appellate court's reasoning. The judges held that taxing these specific fees lacked statutory backing. They emphasized a fundamental legal principle: where the law is vague, the benefit of the doubt must go to the taxpayer, not the state.

“The subject is not to be taxed unless the words of the taxing Statute unambiguously impose the tax upon him,” the judges noted in their ruling.

The Court clarified the nature of these payments:

By setting aside the 2020 decision, the Supreme Court has dismissed the KRA’s demand against Absa and ordered each party to bear its own costs. The judgment provides much-needed certainty for financial institutions, reinforcing that genuine operational costs cannot be arbitrarily reclassified to widen the tax net.

For the banking industry, this is more than a legal victory; it is a stabilization of their operating environment. As the digital economy grows, the ruling ensures that the infrastructure facilitating cashless payments remains a service to be maintained, rather than a new avenue for taxation.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago