We're loading the full news article for you. This includes the article content, images, author information, and related articles.

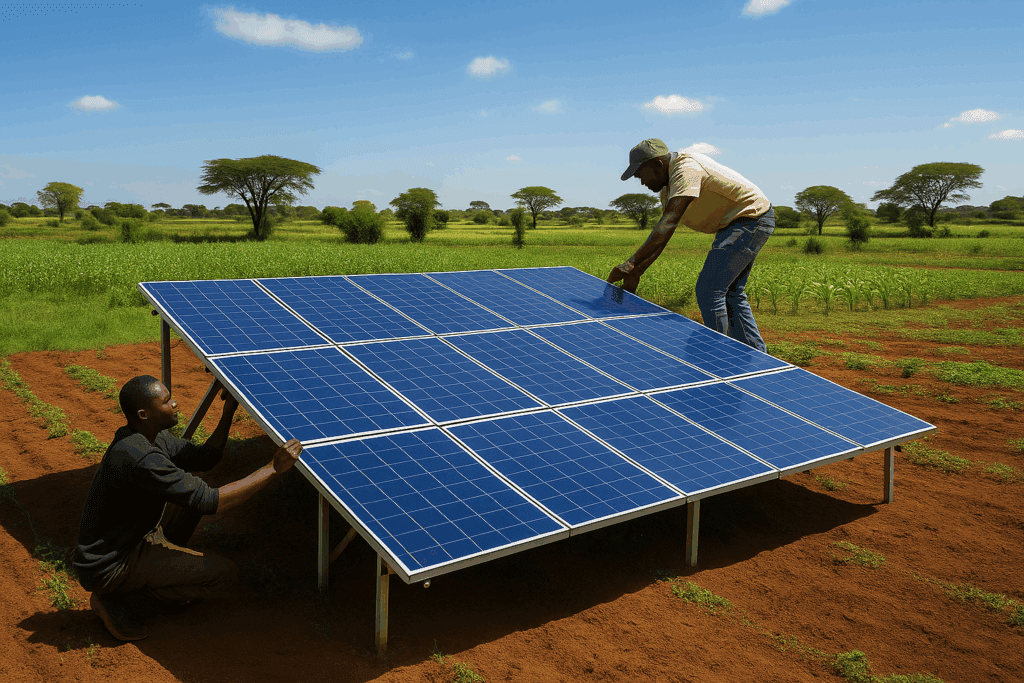

A massive 60% increase in Africa's solar panel imports is being driven by hundreds of small- and medium-sized enterprises. In Kenya, these businesses are accelerating energy access and job creation, positioning the nation as a regional leader in the clean energy transition.

Africa is experiencing an unprecedented boom in solar energy adoption, with solar panel imports surging by 60% in the year leading up to Thursday, June 26, 2025. According to an analysis by the energy think tank Ember, the continent imported a record 15,032 megawatts (MW) of solar modules, up from 9,379 MW in the previous 12-month period. This growth is not confined to a few large-scale projects; instead, it is largely propelled by a dynamic network of hundreds of small and medium-sized importers and distributors meeting a rising tide of demand from households and businesses seeking reliable and affordable alternatives to unstable national grids and expensive diesel generators.

While South Africa remains the continent's single largest importer (3,784 MW), the most dramatic growth has occurred elsewhere. Imports to African nations excluding South Africa nearly tripled over the last two years, rising from 3,734 MW to 11,248 MW. This widespread adoption is highlighted by the fact that 25 countries each imported at least 100 MW, a significant increase from 15 countries the previous year. Some of the most remarkable growth rates were seen in Algeria, where imports grew thirty-threefold, and Zambia, which saw an eightfold increase.

Within East Africa, Kenya has firmly established itself as the regional leader. In the 12 months to June 2025, the country imported 495 MW of solar panels, the highest in the region. This represents a 147.5% increase since 2021, when imports stood at 200 MW. This growth is a direct response to high national electricity tariffs and an increasing desire for energy independence among commercial and industrial (C&I) entities. Tanzania followed closely, importing 422 MW, while other neighbours like Uganda (77 MW), Ethiopia (89 MW), and Rwanda (4 MW) are also part of this growing trend, albeit at a smaller scale.

The Kenyan market's vibrancy is driven by a robust ecosystem of local SMEs. Companies like Davis & Shirtliff, PowerGen Renewable Energy, and Solinc East Africa are critical links in the supply chain, importing, distributing, and installing solar systems across the country. These firms, which numbered over 1,600 by the 2023/24 financial year, are instrumental in translating bulk international shipments into practical, localised energy solutions, from urban rooftop installations to rural mini-grids. This activity is creating significant employment, with projections suggesting Kenya’s solar value chain could support over 111,000 direct jobs by 2030.

The narrative of Africa's solar surge is incomplete without highlighting the central role of agile, small-scale businesses. In South Africa, companies like Joule Energy Solutions, the sole importer of TBB POWER inverters, exemplify how local distributors create value by testing and adapting products for local conditions, thereby empowering hundreds of installers. This model is replicated across the continent, including in Kenya, where distributors for major brands like TBB POWER, Solis, and Astronergy are readily found.

This distributed, SME-led model is particularly effective at reaching underserved populations. In Kenya, innovative Pay-As-You-Go (PAYG) models pioneered by companies like M-KOPA and d.light have revolutionized energy access for low-income households. By allowing customers to make small, incremental payments via mobile money, these companies have made solar home systems affordable for millions, significantly contributing to the rise in national electricity access from 37% in 2013 to 79% in 2023. It is estimated that over three million Kenyan households now depend on off-grid solar products.

Despite the remarkable growth, the sector faces challenges. The heavy reliance on imports, primarily from China which produces over 80% of the world's solar panels, exposes African markets to global supply chain volatility and foreign exchange risks. Furthermore, government policy remains a critical, and sometimes unpredictable, factor. In Kenya, the solar industry has previously faced the threat of VAT and import duties on solar products, which stakeholders warned could increase costs, destroy thousands of jobs, and slow down rural electrification. Currently, supportive policies, including VAT exemptions for solar equipment, are a key driver of the market's success.

The surge in distributed solar also presents a long-term challenge for traditional utility companies, which risk losing revenue as more affluent customers move off-grid, potentially leaving fewer customers to cover the costs of maintaining the national grid. However, the overwhelming momentum is clear. Driven by falling global prices and relentless local demand, the proliferation of small-scale solar, facilitated by a growing network of local importers and entrepreneurs, is fundamentally reshaping Africa's energy landscape. For Kenya and its neighbours, this trend promises a faster, more inclusive path to energy security and sustainable development.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago