We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The new Micro and Small Taxpayers Department aims to bring millions of informal businesses into the tax net, a move the government says is crucial for revenue growth but which traders fear could stifle economic activity.

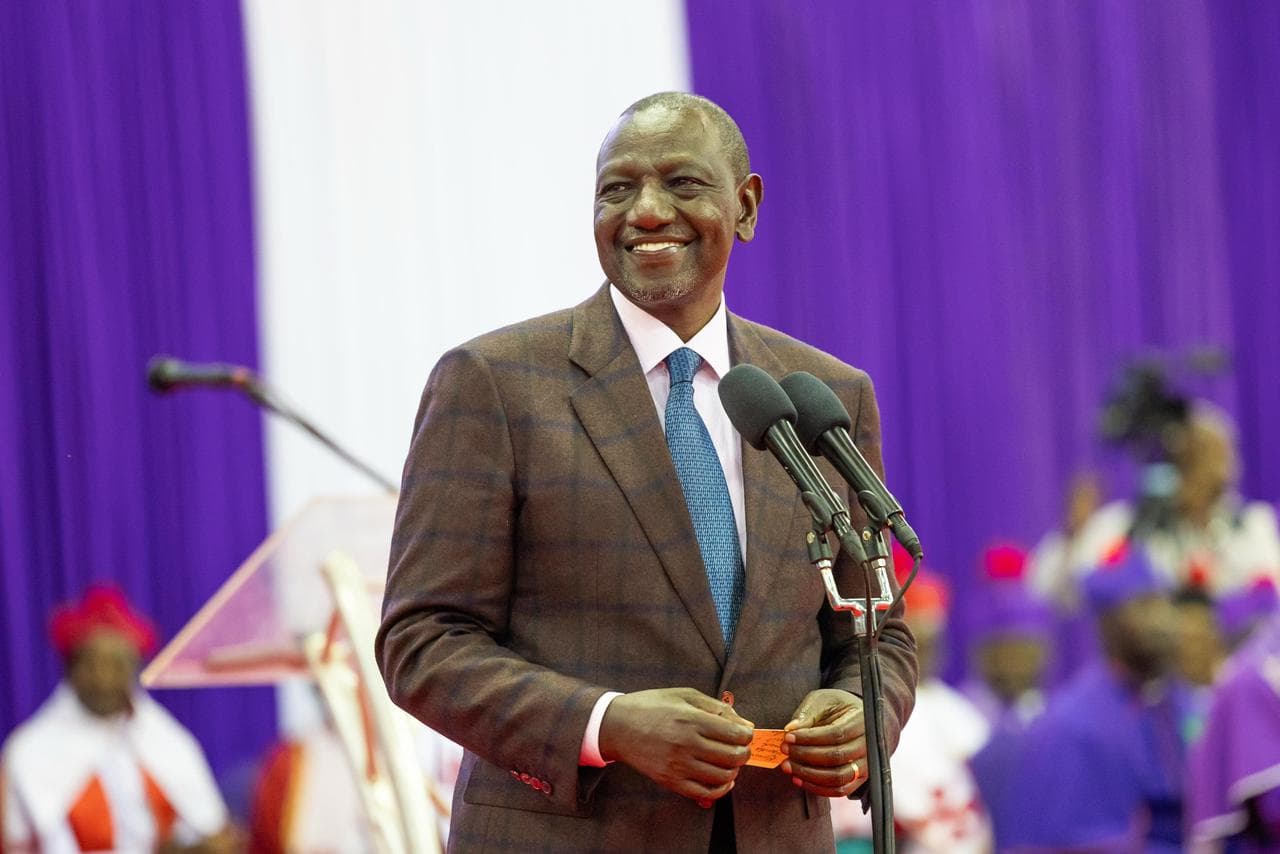

President William Ruto has officially launched a specialized Kenya Revenue Authority (KRA) department dedicated to boosting tax compliance among the country's millions of small and medium-sized enterprises (MSMEs). The new unit, named the Micro and Small Taxpayers Department, is tasked with simplifying tax processes and expanding the revenue base by onboarding an additional five million businesses.

Speaking at the annual Taxpayers' Dinner at State House, Nairobi, on Thursday, 20 November 2025, President Ruto described the MSME sector as the country's largest untapped revenue segment. He highlighted a significant disparity in the current tax system, noting that while MSMEs contribute approximately 33% of Kenya's Gross Domestic Product (GDP) and employ nearly 15 million people, they account for only 1% of tax revenue. "This new department will help expand our tax base, ensuring everyone shares the responsibility of nation-building," the President stated.

The government's strategy is to shift from enforcement to facilitation. The new unit will offer personalized support, simplified compliance procedures, and technology-driven tools to make tax payment more accessible for small business owners. This approach is part of a broader reform agenda aimed at fostering a culture of voluntary compliance rather than relying on "pressure or punishment," according to the President.

The establishment of a dedicated MSME department marks a significant change in KRA's structure. Previously, the authority primarily focused on large and medium-sized taxpayers through dedicated offices, leaving small traders without tailored support. The new department, headed by Commissioner George Obell, a seasoned tax expert, aims to address the unique challenges faced by small businesses, such as complex tax laws and digital access barriers.

Recent KRA initiatives signal this new approach. The tax authority has introduced a USSD service (*222#) and a WhatsApp chatbot to allow taxpayers to access services without requiring a smartphone or stable internet. Furthermore, KRA plans to recruit 10,000 agents this year to provide basic services like registration and tax filing in rural and remote areas, mimicking the successful agent model used by banks.

These efforts are underpinned by a heavy reliance on technology. KRA is leveraging Artificial Intelligence (AI), Machine Learning, and data analytics to simplify processes and identify revenue leakages. President Ruto praised these technological advancements, noting that AI-powered risk engines have already contributed to a record Sh85 billion in customs revenue last month and a rise in domestic VAT collections from Sh20 billion in 2021/22 to Sh28 billion currently.

While the government frames the initiative as a supportive measure, some business owners and analysts remain cautious. The primary concern is that increased scrutiny could raise the cost of compliance and create administrative burdens, potentially stifling the growth of a sector already grappling with economic pressures. Studies have shown that high tax rates and complex policies can negatively impact the growth of SMEs by reducing their profit margins and capital for reinvestment.

Organizations like the Kenya National Chamber of Commerce and Industry (KNCCI) have been in continuous dialogue with KRA to advocate for a predictable and transparent tax environment. In recent meetings, KNCCI has emphasized the need for collaborative measures, such as joint tax education clinics and simplified digital tools like eTIMS, to build trust and encourage voluntary compliance rather than enforcing punitive measures.

The success of the new Micro and Small Taxpayers Department will depend on its ability to balance revenue targets with the need to nurture the fragile MSME ecosystem. The government has expressed confidence in hitting its Sh3 trillion revenue target for the current financial year, with the expanded tax base being a critical component of this goal. The key challenge will be to ensure that in the quest for revenue, the engine of the Kenyan economy—its small businesses—is supported, not suppressed.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago