We're loading the full news article for you. This includes the article content, images, author information, and related articles.

President William Ruto has signed new legislation that streamlines the privatisation of state-owned enterprises, paving the way for the sale of 11 government-controlled entities to boost revenue and reduce reliance on public funds.

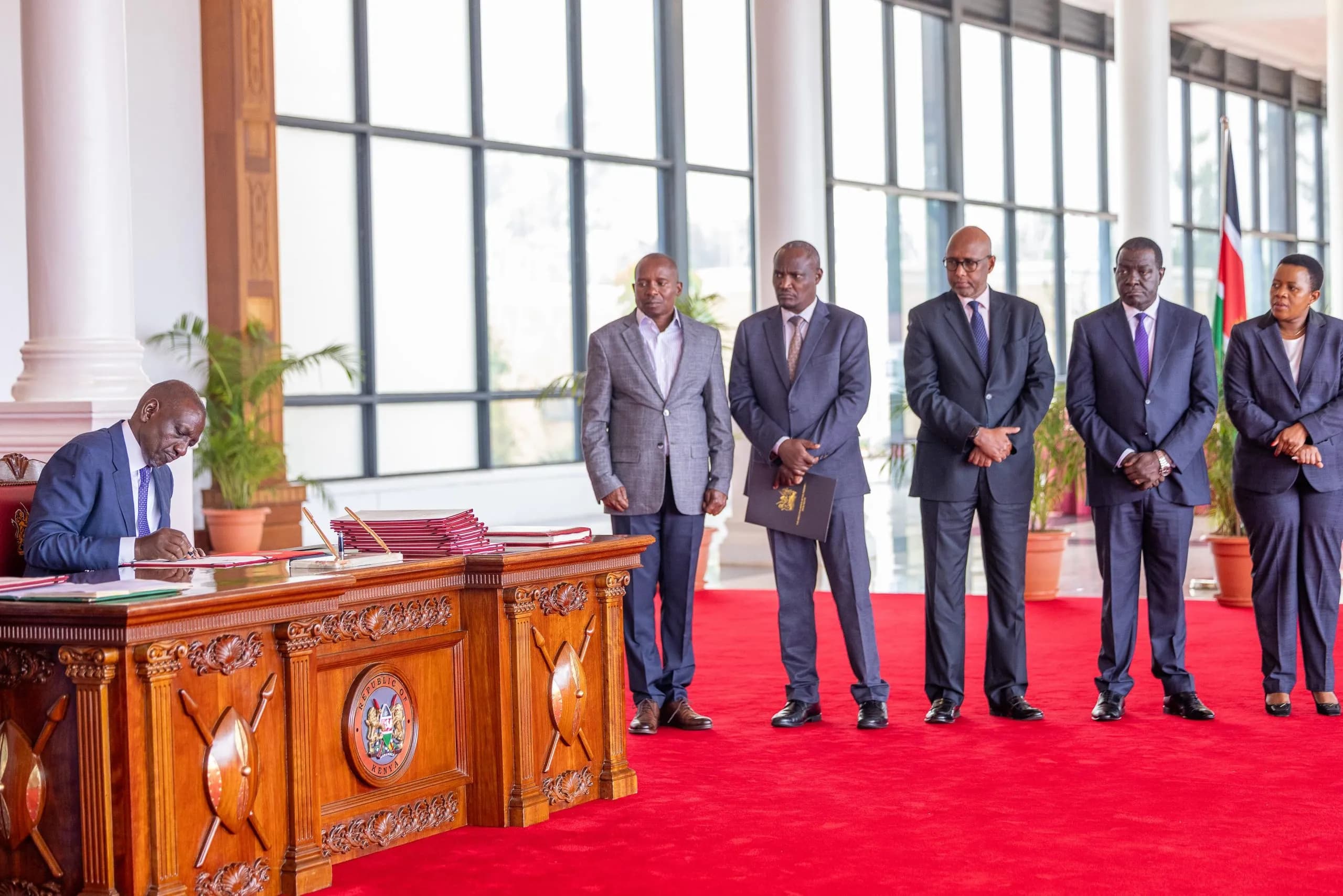

President William Ruto on Wednesday, October 15, 2025, assented to the Privatisation Bill, 2025, officially clearing the path for the sale of 11 state-owned firms. This move is a significant step in the government's strategy to reduce its financial burden from loss-making entities and generate revenue for development projects.

The newly enacted Privatisation Act, 2025, replaces the Privatisation Act, 2005, and aims to remove bureaucratic hurdles that previously slowed down the divestiture process. The government's objective is to encourage greater private sector participation in the economy, improve the efficiency of public services, and enhance capital markets.

Kenya's privatisation journey dates back to Sessional Paper No. 10 of 1965 on African Socialism, which sought to accelerate economic development and increase Kenyan citizen participation in the economy. However, earlier privatisation efforts had limited impact due to the small scale of entities involved and a lack of a robust legal framework.

The previous Privatisation Act of 2005 required parliamentary approval for each privatisation, a process that often led to delays. President Ruto's administration has consistently advocated for a streamlined approach, proposing to privatise a significant number of state corporations to inject much-needed capital into the economy and reduce government expenditure.

The Privatisation Act, 2025, grants the Cabinet Secretary for the National Treasury the authority to formulate the privatisation programme, which then requires approval from the Cabinet and ratification by the National Assembly. This new framework aims to expedite the process by reducing the layers of approval.

Under the new law, proceeds from the sale of direct National Government shareholding will be deposited into the Consolidated Fund. The Act also outlines various privatisation methods, including initial public offerings (IPOs) of shares, sale of shares by public tender, and sale resulting from pre-emptive rights.

The government's push for privatisation has been met with mixed reactions. Proponents argue that it will attract investment, reduce the fiscal burden, and improve service delivery. They highlight that many state-owned enterprises have been inefficient and unprofitable, stifling private sector initiatives.

However, some opposition groups, such as the Azimio la Umoja coalition, have expressed concerns that the privatisation process could be tailored to benefit a few individuals. A High Court ruling in September 2024 temporarily overturned the Privatisation Act, 2023, citing a lack of proper public participation, though the government has since re-engaged with the process.

The National Treasury identified 11 state-owned enterprises for privatisation as part of the 2023 Privatisation Programme. These include both profitable and loss-making entities.

The government aims to raise KSh 100 billion from the privatisation of KPC alone to support the budget.

The privatisation programme carries potential risks, including concerns about transparency and the equitable distribution of benefits. The previous legal framework was criticised for institutional and process weaknesses. The government is keen to avoid creating unregulated monopolies or according new owners special protections.

Successful privatisation, however, could lead to improved efficiency, increased investment, and a reduction in the government's fiscal burden, allowing resources to be reallocated to critical sectors like infrastructure, healthcare, and education.

While the list of 11 firms has been published, the specific timelines for the sale of all entities, beyond KPC, remain largely undisclosed. The methods of privatisation for each firm will likely depend on their financial health, with profitable entities potentially going for IPOs and loss-making ones seeking strategic investors.

The Privatisation Act, 2025, commenced implementation on October 27, 2023. The National Treasury invited public input on the initial list of 11 firms until December 11, 2023. The government has set a deadline of March 31, 2026, for the listing of KPC shares on the Nairobi Securities Exchange (NSE).

Observers will be keenly watching the implementation of the new Privatisation Act, particularly regarding transparency in the sale process and the actual impact on the efficiency and profitability of the privatised entities. The government's ability to attract significant local and international investment will also be a key indicator of the programme's success. Further announcements on the privatisation of the remaining firms on the list, and potentially others from the broader list of 35 identified state-owned enterprises, are anticipated.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago