We're loading the full news article for you. This includes the article content, images, author information, and related articles.

As high earners face a 50% jump in pension deductions next month, the government pitches a 'savings revolution' to a workforce barely scraping by.

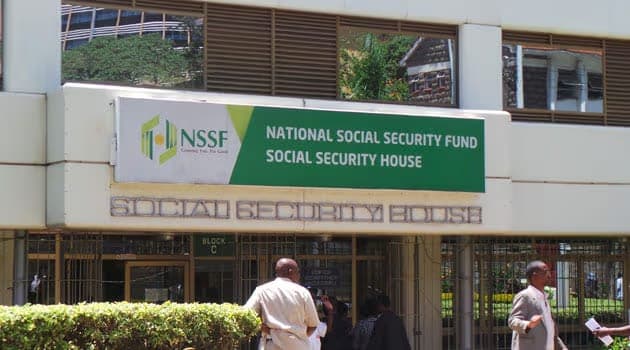

The New Year celebrations have barely faded, but for thousands of Kenyan professionals, a financial hangover is already looming. Come February, pay slips for those earning above Sh100,000 will look significantly lighter. The government’s directive to raise National Social Security Fund (NSSF) contributions to Sh6,480 (approx. $50)—up from Sh4,320—is not just a policy tweak; it is a litmus test for the administration’s boldest economic gamble yet.

On paper, the logic is sound: Kenya must save its way out of debt. But on the ground, in households from Kilimani to Kitengela, the question is simpler and more urgent: Can we afford to save for a future we are struggling to reach?

The new rates, effective February 2026, target the country’s top tier of formal employees. For a manager earning Sh100,000, the deduction jumps by Sh2,160 per month. In an economy where the price of fuel and school fees continues to climb, that sum represents a significant chunk of disposable income.

Treasury officials argue this is necessary pain. Kenya’s gross savings rate has historically lagged behind peers like Tanzania and Uganda, hovering below 15% of GDP. The administration’s goal is to emulate the "Singapore Model," where robust domestic savings fund massive infrastructure projects, reducing reliance on expensive foreign loans.

However, the resistance to this hike is not merely financial; it is psychological. For decades, the NSSF has battled a reputation for inefficiency. A recent audit by the Controller of Budget highlighted persistent issues: missing contribution records, agonizing delays in processing retiree benefits, and opaque investment decisions.

"It is not that Kenyans hate saving," noted a senior labor analyst in Nairobi. "It is that they fear their money enters a black hole. When you see retirees camping at NSSF offices for years to get their dues, you understand why a 30-year-old executive is skeptical about handing over more cash today."

The government insists that reforms are underway. New digital systems promise real-time tracking of contributions, and the Fund has pledged greater transparency in its portfolio, which includes major real estate and equity investments. Proponents point out that without this shift, the alternative is grimmer: higher taxes or more crippling foreign debt.

Yet, for the average worker, the "long term" is a luxury. With inflation eating into purchasing power, the immediate reduction in take-home pay will force tough choices at the kitchen table. The success of this policy will not depend on the mathematics of compound interest, but on whether the state can convince its citizens that this time, their sacrifice will actually pay off.

As February approaches, the burden of proof lies squarely with the NSSF. They must demonstrate that they are not just collectors of revenue, but competent custodians of the Kenyan dream.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago