We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Prime Cabinet Secretary dismisses "selling family silver" fears, citing the telco giant’s rise as proof that reducing state control unlocks billions in value.

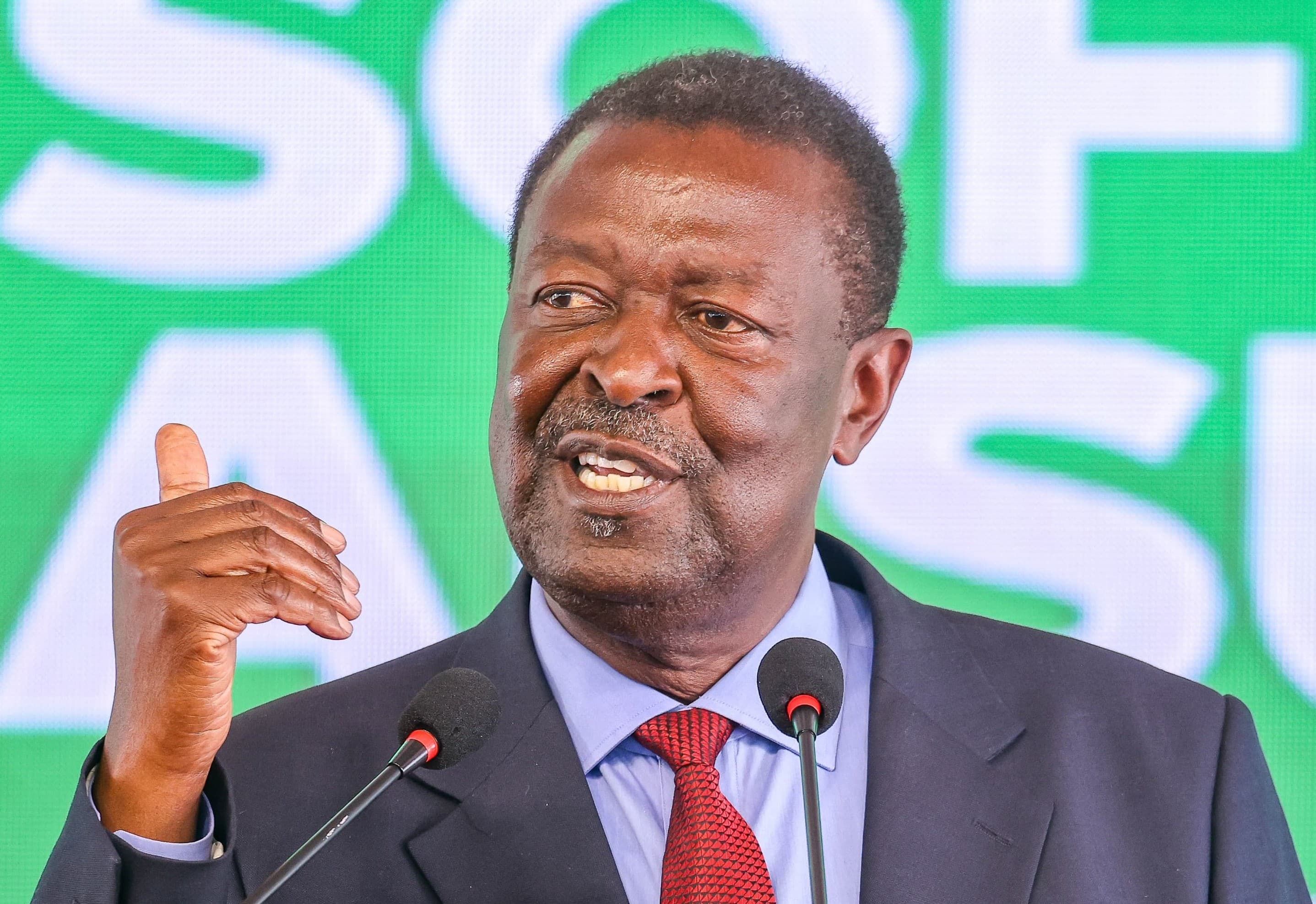

Prime Cabinet Secretary Musalia Mudavadi has doubled down on the government’s controversial privatization agenda, arguing that the state should loosen its grip on even more public enterprises to replicate the "miracle" of Safaricom.

Speaking at the launch of the Kenya Diaspora Investment Strategy 2025–2030 in Nairobi on Tuesday, Mudavadi offered a spirited defense of the policy that has sparked heated debate across the country. His message was blunt: holding onto loss-making monopolies is not patriotism; it is economic sabotage.

Mudavadi urged critics to look in the rearview mirror at the defunct Kenya Post and Telecommunications Corporation (KPTC). Once a monolithic state monopoly, KPTC was notorious for inefficiency before its unbundling birthed Safaricom.

“It is from that brave move that Kenyans made to embrace the private sector that made Safaricom the giant that it is today,” Mudavadi noted, emphasizing that the telco is now the largest private-sector investor in neighboring Ethiopia—a feat he argued would have been impossible under full government control.

The Prime Cabinet Secretary clarified that the state currently holds about 35 percent of Safaricom. He posited that reducing government shareholding to 33 percent or below effectively transforms a parastatal into a private company where the state sits merely as an investor, not a manager.

The push comes as the government seeks to implement the Privatization Act 2025, which replaced the 2005 legal framework to fast-track the sale of state-owned enterprises (SOEs). The Treasury has previously flagged high-profile entities for potential stake sales, including:

Critics, including opposition leaders and civil society groups, have warned that rushing these sales could lead to the undervaluation of public assets. There are fears that strategic national interests could be auctioned off to the highest bidder, potentially driving up the cost of essential services for the average Kenyan.

By linking this announcement to the Diaspora Investment Strategy, Mudavadi is signaling a clear target market: the millions of Kenyans abroad who sent home over KES 650 billion last year. The government is betting that diaspora inflows can be diverted from consumption and real estate into buying shares in these privatized firms.

“We want to see diaspora capital driving our capital markets,” Mudavadi said. “When we list these companies, we are giving Kenyans—here and abroad—a chance to own a piece of their country’s economy.”

While the logic of efficiency is compelling, the political hurdle remains high. For the mwananchi struggling with the cost of living, the promise of a "future Safaricom" must be weighed against the immediate risk of losing control over public utilities.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago