We're loading the full news article for you. This includes the article content, images, author information, and related articles.

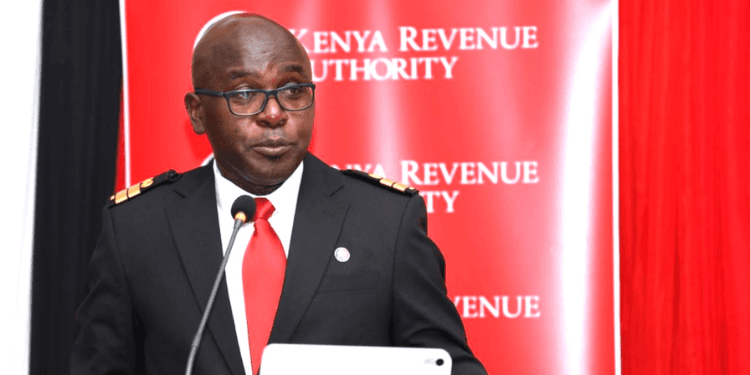

The Kenya Revenue Authority (KRA) has directed employers to strictly apply all eligible income tax deductions, reliefs, and exemptions when computing Pay As You Earn (PAYE) for employees, effective October 2, 2025.

The Kenya Revenue Authority (KRA) has issued a public notice to employers, employees, and the general public regarding the mandatory application of income tax deductions, reliefs, and and exemptions. The directive, issued on Thursday, October 2, 2025, takes immediate effect and is a direct consequence of amendments to the Income Tax Act, Cap 470, through the Finance Act, 2025.

This move by the KRA aims to streamline the computation of Pay As You Earn (PAYE) for employee emoluments, ensuring that all eligible tax benefits and statutory requirements are accurately reflected. Employers are now legally obligated to factor in these provisions, which include personal relief, insurance relief, mortgage interest deductions, and contributions to registered pension schemes and Post-Retirement Medical Funds.

The Finance Act, 2025, assented into law by the President on June 27, 2025, and subsequently published in the Kenya Gazette, introduced a wide range of changes to Kenya's tax laws. While previous Finance Acts often focused on significant changes for salaried individuals, the 2025 Act primarily seeks to broaden the tax base to meet an estimated revenue target of KES 3.32 trillion. The Act's provisions generally came into effect on July 1, 2025, with some exceptions slated for January 1, 2026.

Among the key changes in the Finance Act, 2025, are the expansion of the per diem benefit from KES 2,000 to KES 10,000 and the limitation of carrying forward tax losses to five years. The Act also repealed the Digital Assets Tax under the Income Tax Act, replacing it with a 10% excise duty on fees charged on virtual asset transactions by virtual asset providers.

Under the new KRA directive, employers are specifically required to:

The KRA has also emphasised the importance of accurate and timely submission of PAYE returns, reflecting all applicable reliefs, deductions, and exemptions. Employees are advised to promptly provide their employers with all required documentation to support claims for deductions and reliefs.

This directive is expected to influence public debate and policy execution, with stakeholders urging for further clarity on implementation timelines, associated costs, and safeguards. The KRA's move underscores a broader governmental fiscal policy for the Financial Year 2025/26, which focuses on fiscal consolidation to reduce public debt and allocate resources for essential public services.

The KRA has invited interested members of the public, professionals, and stakeholders to submit their inputs and comments for consideration in the finalisation of related regulations. Draft regulations have been posted on the KRA website, with submissions to be received by October 7, 2025.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago