We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Kenya’s live music scene is rebounding with revenues projected to grow steadily, fueled by a vibrant festival culture and digital innovation. However, significant challenges around infrastructure and artist pay persist.

NAIROBI, KENYA – Kenya's live music industry is experiencing a robust post-pandemic resurgence, with ticket sale revenues reaching US$1 million (approximately KSh 130 million) in 2024 and projected to grow at a compound annual growth rate (CAGR) of 2.1% through 2029. This forecast, detailed in the PwC Africa Entertainment and Media Outlook 2025–2029, positions Kenya for steady growth, slightly outpacing Nigeria’s projected 1.8% CAGR. The sector's revival signals a significant shift in the nation's creative economy, driven by a growing middle class, a youth-driven concert culture, and the deep integration of digital technology.

The growth is largely propelled by the success of major music festivals that have become cultural staples. Events like Blankets & Wine, founded in 2008 by Muthoni Ndonga (also known as Muthoni the Drummer Queen), and the artist-led Sol Fest by the band Sauti Sol, now attract tens of thousands of attendees. For instance, the 2023 edition of Sol Fest targeted 15,000 attendees and cost between KSh 50 million and KSh 70 million to produce, demonstrating the significant financial scale of these events. Last year's Sol Fest generated an estimated KSh 70 million from ticket sales alone.

A key driver of this transformation is the fusion of live experiences with digital platforms. Promoters have increasingly adopted e-ticketing, with mobile money platforms like M-Pesa playing a central role in streamlining payments. Social media, particularly TikTok, has become an indispensable tool for music discovery and promotion, with 75% of Kenyan users reporting they discover new artists on the platform. This digital ecosystem amplifies marketing reach and creates new revenue streams long after the concerts end.

The economic ripple effects extend beyond ticket sales. Major festivals stimulate local economies by boosting tourism, hospitality, and transportation sectors. They also create numerous temporary jobs in security, logistics, and vendor services, contributing to the creative economy which accounts for approximately 5% of Kenya's GDP. Recognizing this potential, the Kenyan government has allocated KSh 16.3 billion for the 2024/2025 fiscal year to the Digital Superhighway and Creative Economy pillar, aiming to foster job creation and economic transformation. President William Ruto has publicly stated his administration's commitment to strengthening copyright laws and developing the creative sector into a key economic driver.

Despite the sector's promising growth, challenges remain that create an uneven playing field for artists and organizers. While top-tier musicians command significant fees—Sauti Sol reportedly charges upwards of KSh 1 million for local shows, and artists like Otile Brown and Bien-Aime Baraza earn between KSh 500,000 and KSh 857,000 per performance—many emerging and mid-tier artists struggle. Issues such as delayed payments, lack of standardized gig rates, and high personal costs for production and band rehearsals mean that a sustainable income from live performances is often out of reach for many.

Event organizers also face significant obstacles. Inadequate infrastructure, including a lack of viable, large-scale venues, remains a primary concern. Furthermore, security is a major challenge, with incidents of overcrowding, unauthorized access, and logistical failures marring several recent high-profile concerts. These security lapses not only pose safety risks but also tarnish Kenya's reputation as a premier destination for international events.

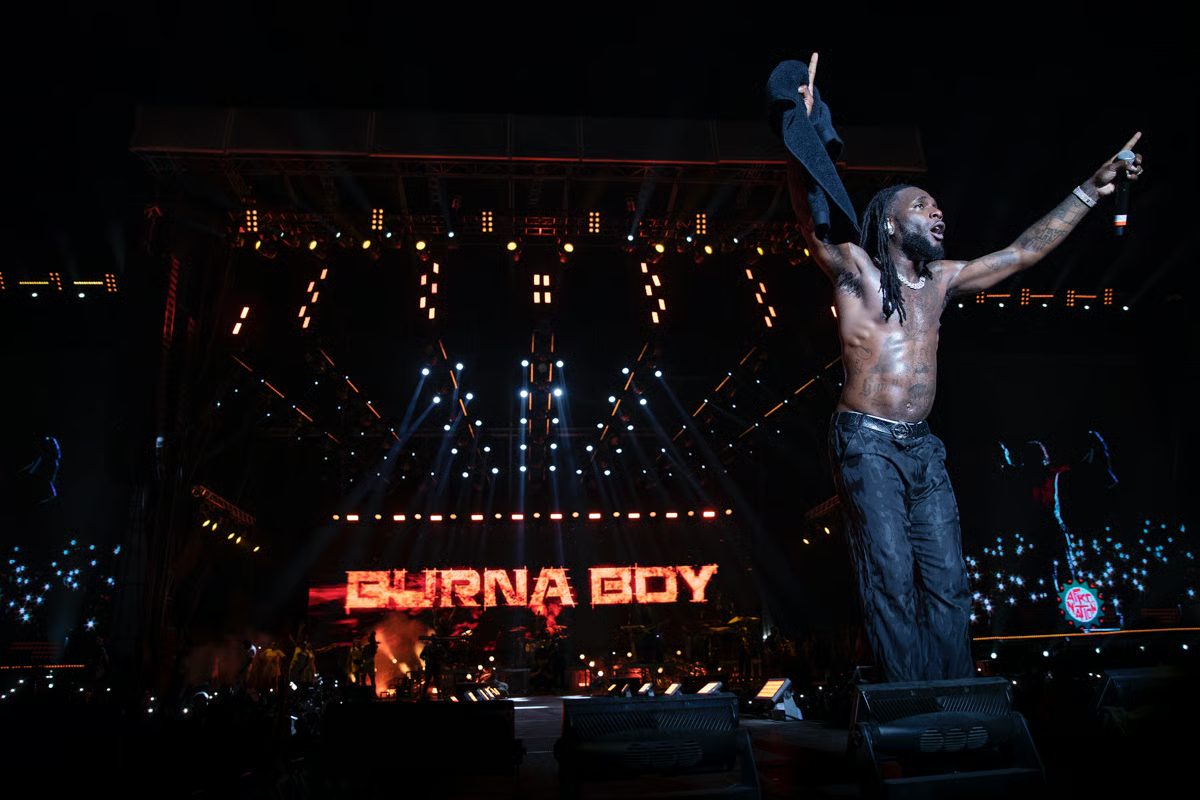

Within the broader African context, Kenya's live music market is modest in scale compared to continental leader South Africa, which generated US$76 million in ticket revenue in 2024 and boasts a projected CAGR of 5.9%. However, Kenya's growth trajectory is indicative of a wider trend across East Africa, where a young, tech-savvy population is driving demand for local and regional content. While specific revenue data for neighboring Uganda and Tanzania is limited, reports indicate their markets are also expanding, driven by a growing middle class and the rise of digital streaming platforms. The entire Sub-Saharan Africa region saw recorded music revenues climb by 22.6% in 2024, surpassing $100 million for the first time.

The future of Kenya's live music scene hinges on addressing its structural weaknesses. The government's proposed Creative Economy Support Bill aims to provide a formal framework for monetization and reduce regulatory hurdles. For sustained and equitable growth, industry stakeholders emphasize the need for greater investment in infrastructure, improved security protocols, and a more transparent system that ensures fair compensation for all artists. If these challenges are met, the sector is well-positioned to not only meet but exceed its growth projections, solidifying Kenya's status as a vibrant cultural hub in East Africa.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago