We're loading the full news article for you. This includes the article content, images, author information, and related articles.

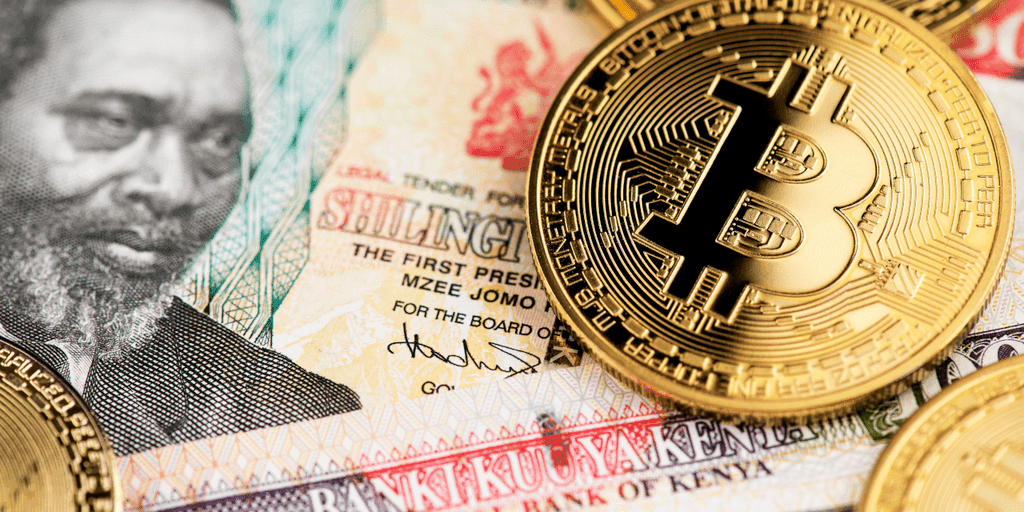

Kenya's Parliament has passed a landmark bill to regulate digital assets, aiming to attract investment, enhance investor confidence, and position the nation as a leader in Africa's rapidly growing digital economy. The legislation now awaits presidential assent.

Nairobi, Kenya – Kenya is on the cusp of establishing a comprehensive legal framework for digital assets, including cryptocurrencies, following the parliamentary approval of the Virtual Asset Service Providers (VASP) Bill. The bill, which passed its third reading last week, now awaits President William Ruto's signature to become law. This move is anticipated to transform Kenya into a regional hub for cryptocurrency innovation and investment.

The legislation seeks to provide much-needed clarity in a sector that has previously operated with regulatory uncertainty, thereby boosting investor confidence and stimulating growth in Kenya's digital asset market. Kuria Kimani, the Chairman of the National Assembly's Finance Committee, highlighted that the bill draws inspiration from established regulatory frameworks in countries like the United States and the United Kingdom.

Kenya's journey towards cryptocurrency regulation has evolved from initial skepticism to a more embracing stance. In December 2015, the Central Bank of Kenya (CBK) issued a public notice cautioning Kenyans against virtual currencies like Bitcoin, citing concerns over their unregulated nature, potential for fraud, and volatility. Despite these warnings, the adoption of cryptocurrencies continued to grow, driven by factors such as the desire for financial inclusion and the potential for high returns.

By 2022, nearly 10% of Kenyans owned some form of cryptocurrency, according to a report by the United Nations Conference on Trade and Development (UNCTAD). The government's perspective began to shift as it recognized the transformative potential of digital financial services, building on the success of mobile money platforms like M-Pesa. In 2018, a government task force was established to explore blockchain and artificial intelligence, marking a more open approach to digital currencies.

The Virtual Asset Service Providers Bill 2025 establishes a dual regulatory framework, assigning oversight responsibilities to existing financial institutions. The Central Bank of Kenya (CBK) will be responsible for licensing stablecoins and other virtual assets, while the Capital Markets Authority (CMA) will supervise crypto exchanges and trading platforms. This approach replaces an earlier proposal for a new, standalone Virtual Assets Regulatory Authority, streamlining supervision under existing agencies.

The new law mandates that companies offering digital assets must segregate client funds, obtain insurance coverage, and open bank accounts within Kenya to facilitate supervisory oversight. It also empowers regulators to inspect, supervise, and impose sanctions on non-compliant operators. Furthermore, the Finance Act 2025 repealed the contentious 3% digital asset tax on asset value, replacing it with a 10% excise duty on fees charged by virtual asset platforms, shifting the tax burden to service consumption.

Kuria Kimani emphasized that the new legislation aims to turn the enthusiasm of young Kenyans, particularly those aged 18 to 35 who actively use virtual assets for trading, payments, and investment, into a structured market that drives economic growth. He expressed hope that Kenya could become Africa's gateway for digital assets by providing a regulated environment.

The Capital Markets Authority (CMA) has actively worked towards establishing regulatory oversight in Kenya's virtual asset sector, recognizing the rapid adoption of digital financial products. The CMA's Virtual Assets Service Providers Bill, 2025, aims to create a structured framework for digital finance transactions, balancing market integrity with investor protection.

Kenya is recognized as a leader in cryptocurrency adoption in Africa. Between July 2024 and June 2025, the cryptocurrency market in sub-Saharan Africa grew by 52% year-on-year, reaching over $205 billion, with Kenya ranking among the countries with the highest adoption rates worldwide, according to Chainalysis. In the 12-month period ending in June 2024, users in Kenya conducted transactions worth approximately KSh 426.4 billion (USD 3.3 billion) in stablecoins.

The new regulatory framework addresses concerns previously raised by the Financial Action Task Force (FATF), which had flagged virtual assets as a reason for Kenya's addition to its grey list due to vulnerabilities to financial crime. The adoption of a legal framework for licensing and supervision of Virtual Asset Service Providers (VASPs) was a key action point for Kenya to enhance its anti-financial crime framework.

While the legislation aims to protect investors and prevent misuse, global regulators have cautioned that an influx of U.S. dollar-backed stablecoins could potentially destabilize weaker national currencies. The new law is expected to provide legal clarity, help protect the national currency, and ensure secure transactions, preventing fraud and abuse.

An earlier version of the bill had proposed the creation of a new Virtual Assets Regulatory Authority (VARA) that would include representation from the crypto industry. However, this provision was removed in Parliament in favor of a dual framework managed by existing agencies. The long-term impact of this dual regulatory structure on innovation and market efficiency remains to be fully observed.

The Virtual Asset Service Providers Bill was passed by Parliament last week, specifically on Tuesday, October 8, 2025, and now awaits President William Ruto's assent to become law. Once signed, regulators are expected to issue detailed subsidiary rules to govern licensing procedures and compliance timelines.

The focus will now shift to President William Ruto's assent to the bill and the subsequent development of detailed regulations by the Central Bank of Kenya and the Capital Markets Authority. The implementation of these regulations will be crucial in shaping Kenya's digital asset landscape and its ambition to become a leading African crypto hub. The response from international crypto companies and fintech startups to the new regulatory environment will also be a key indicator of the bill's success.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

Key figures and persons of interest featured in this article