We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Nairobi is increasingly relying on Beijing's Global Development Initiative to finance major projects, a strategic pivot accelerated by significant cuts to American foreign aid programs that have long supported Kenya's health and economic sectors.

NAIROBI, Kenya – Kenya is executing a significant recalibration of its foreign development partnerships, turning decisively towards China to sustain its ambitious infrastructure and development agenda as financial support from the United States diminishes. This strategic shift, confirmed by senior Kenyan officials in November 2025, positions Beijing as a crucial lifeline for national projects amid a global tightening of development funding and a notable reduction in American overseas commitments.

The move comes as the United States, historically a cornerstone of support for Kenya's public health and civil society sectors, has scaled back its financial assistance. In January 2025, the Trump administration initiated a 90-day review of all U.S. foreign assistance, which was followed by stop-work orders that effectively froze most funding. By July 2025, the U.S. Congress had confirmed significant cuts through a rescissions package, leading to the abrupt suspension of critical programs. This has severely disrupted Kenya's health system, which has relied heavily on American aid. Between 2020 and 2025, the United States Agency for International Development (USAID) had committed approximately $2.5 billion to Kenya, with 80% allocated to health initiatives like the President's Emergency Plan for AIDS Relief (PEPFAR). The funding halt has impacted everything from HIV prevention and malaria net distribution to childhood immunizations and health data systems.

While the U.S. remains a significant trade partner through frameworks like the African Growth and Opportunity Act (AGOA) and the ongoing U.S.-Kenya Strategic Trade and Investment Partnership (STIP) talks, the reduction in direct aid has created a substantial void. This has prompted UN agencies and other international bodies to also look towards China to plug the resulting funding gaps for essential services in Kenya.

In this landscape, China's Global Development Initiative (GDI) has emerged as a strategic anchor for Nairobi. Chinese Ambassador to Kenya, Guo Haiyan, described the GDI as a “global public good” in November 2025, noting that China has channeled over $23 billion into the initiative globally in the last four years, supporting over 1,800 cooperation projects. For Kenya, this partnership has yielded some of the nation's most visible and transformative infrastructure projects, including the Standard Gauge Railway (SGR), the Nairobi Expressway, the Thwake Dam, and the Garissa Solar Plant.

This relationship has solidified Beijing's position as Kenya's largest bilateral creditor. By mid-2025, China accounted for approximately 64% of Kenya's external bilateral debt, amounting to about Sh1.1 trillion. The financial ties continue to deepen. In September 2024, Kenya signed a new $279 million concessional loan with the China Development Bank to advance 16 different road projects. This was followed by a landmark deal in October 2025, where Kenya restructured $3.5 billion of dollar-denominated SGR loans into Chinese yuan, a move projected to save $215 million in debt servicing costs and advance Beijing's goal of internationalizing its currency.

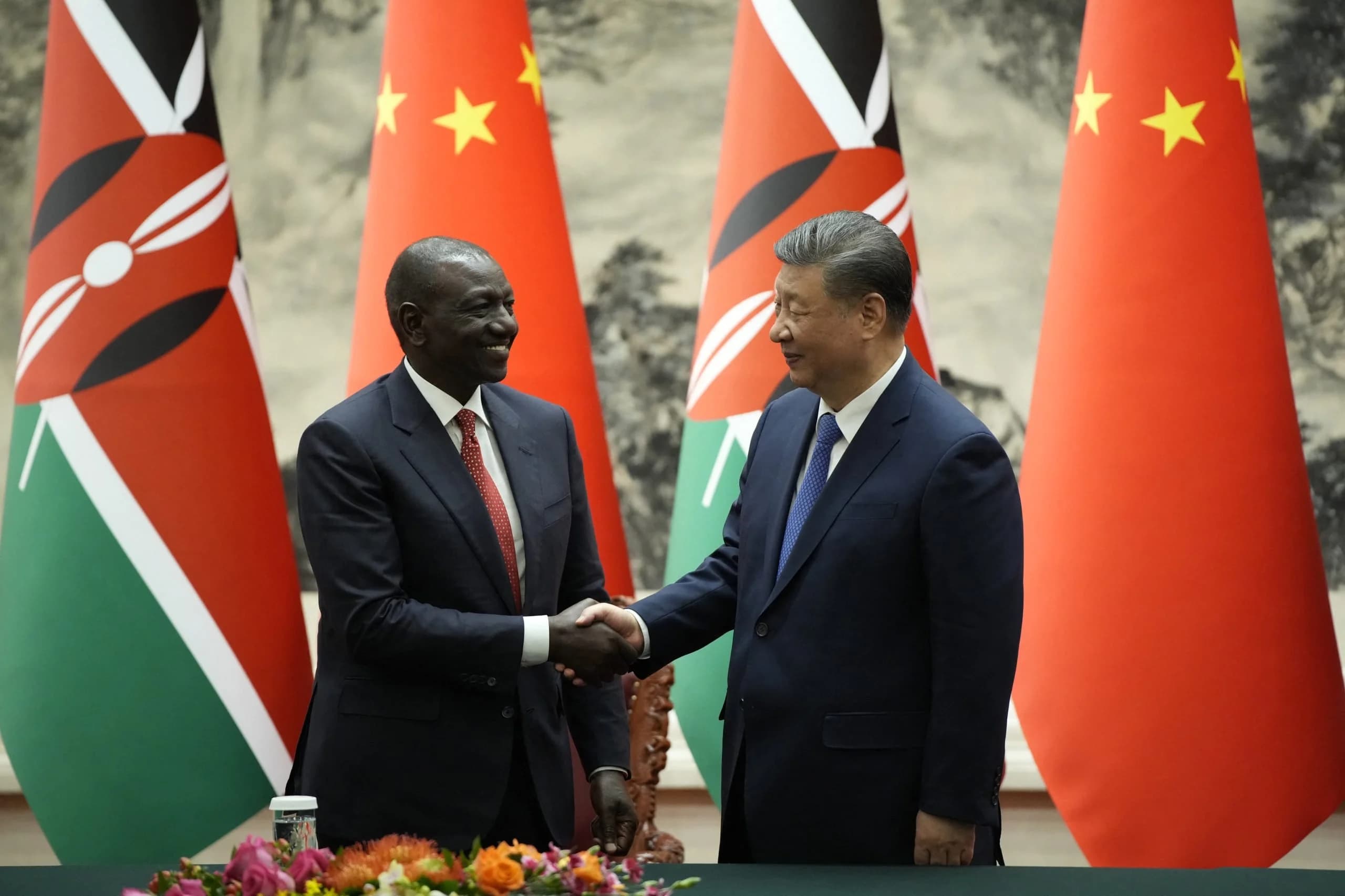

During a state visit to Beijing in June 2025, President William Ruto secured a further financial and investment package worth approximately $1 billion, covering extensions to the SGR, major road projects, and investments in manufacturing, agriculture, and technology that promise over 10,000 new jobs.

This pivot carries profound implications for Kenya's economic sovereignty and long-term development. The reliance on Chinese loans, while fueling critical infrastructure growth, has been a subject of intense public and international debate regarding the country's rising debt burden. As of September 2024, payments to China constituted 39.5% of all external debt servicing by Kenya.

In response, the Kenyan government has signaled a strategy to manage its fiscal pressures. The National Treasury's 2025 Budget Policy Statement indicated a planned 24.3% reduction in net external borrowing for the financial year starting in July, with an increased focus on the domestic market to cover the budget deficit. The government is also pursuing currency diversification in its debt portfolio to hedge against exchange rate volatility.

Lucy Kiruthu, Deputy Director-General for Political and Diplomatic Affairs at the Ministry of Foreign and Diaspora Affairs, stated at a seminar on November 13, 2025, that the GDI provides a strategic anchor in a challenging global financial environment. She affirmed that Kenya “remains ready to continue working closely with China and other like-minded partners to advance sustainable development, bridge financing gaps and ensure that no nation is left behind.” As Western development models face constraints, Kenya's deepening engagement with China marks a pivotal chapter in its pursuit of economic transformation, navigating both the opportunities of new partnerships and the inherent risks of its growing financial obligations.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago