We're loading the full news article for you. This includes the article content, images, author information, and related articles.

The politically connected tycoon battles to save her flagship luxury hotel as creditors close in on a staggering debt mountain.

The five-star Glee Nairobi rises from eight acres of landscaped calm along the Northern Bypass in Runda—211 rooms and suites, multiple restaurants and bars, conference facilities built for Nairobi’s diplomatic and corporate circuit.

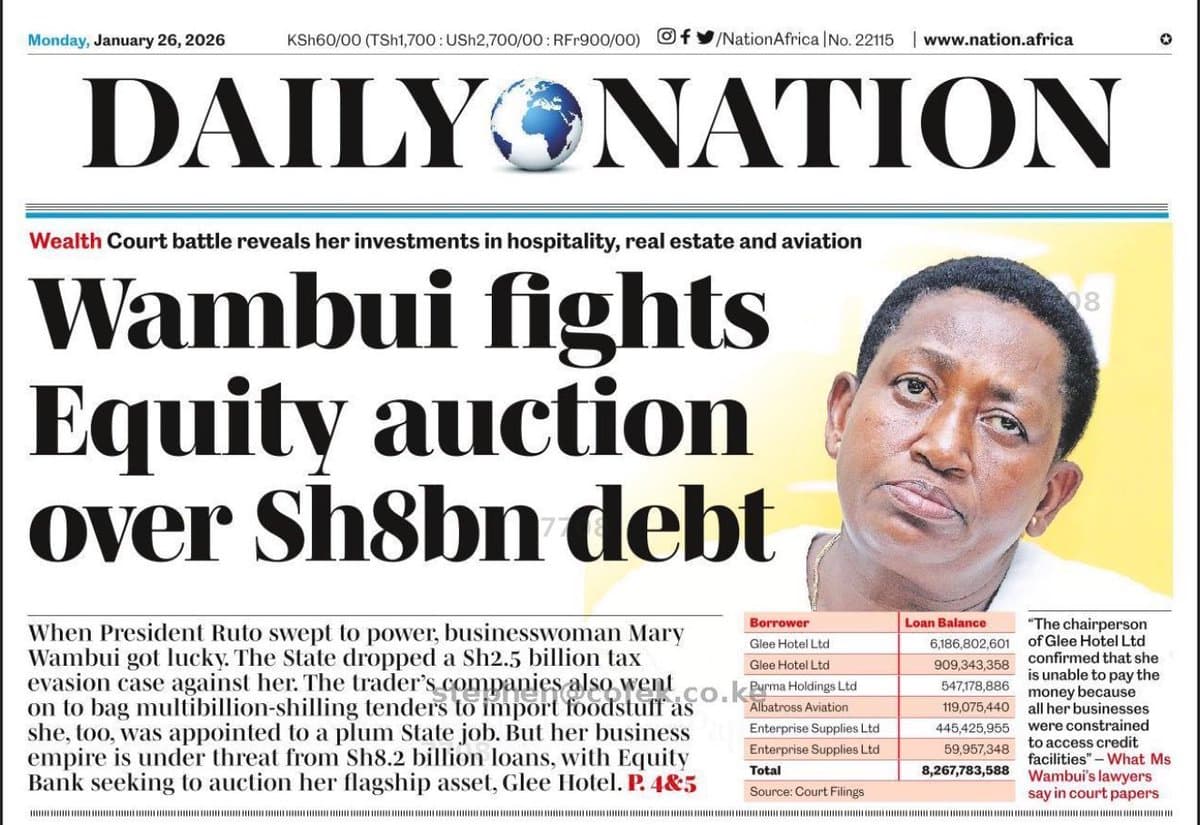

Now, that “crown jewel” is at the centre of a fast-moving court contest: Glee Hotel Ltd and businesswoman Mary Wambui Mungai are seeking to block Equity Bank from auctioning the property as the bank pursues recovery of a reported KSh 8.2 billion debt, with an auction date cited as February 5, 2026.

At face value, this is a familiar Kenyan credit drama: a large, asset-backed facility; a borrower insisting the lender is acting too aggressively; and a bank arguing it must enforce its security once the account becomes non-performing. But beneath that script sit three pressure points that often decide outcomes long before any hammer falls:

1) Time and process (the “was the enforcement clean?” question).

In Kenya’s auction fights, courts routinely zoom in on compliance: statutory notices, redemption periods, service, and whether valuations are current and credible. Borrowers typically seek injunctions by arguing procedural defects or material undervaluation; lenders counter that notices were proper and default is undisputed. (This is the arena where injunctions are won or lost.)

2) Valuation versus recovery (the “is the sale price fair?” question).

The borrower’s most powerful narrative is usually not “we owe nothing,” but “don’t sell a strategic asset at a distressed price.” In a market where forced-sale discounts can be steep, valuation becomes the moral battleground and the legal lever—especially for a complex hospitality asset whose value depends on stabilised cashflows, brand positioning, and forward bookings, not just land and concrete.

3) Liquidity stress across the system (the “why now?” question).

Banks don’t move this hard on headline facilities unless they believe time is working against recovery—either because the borrower’s restructuring talks have stalled, or because the bank wants to avoid a longer slide into impairment.

Kenya’s tourism numbers have been recovering strongly: the Tourism Research Institute’s 2024 performance report records international arrivals at about 2.39 million and reports a sharp rise in inbound earnings to roughly KSh 452.2 billion.

But a rebound in travel demand doesn’t automatically rescue highly leveraged projects, especially those carrying expensive debt from earlier rate cycles.

On the banking side, stress indicators have remained elevated: CBK reporting around mid-2025 showed a gross NPL ratio in the high-teens (about 17.6%), signalling a tougher recovery climate for lenders and borrowers alike.

Even with the CBK easing the policy rate into late 2025 (CBR moving down to 9.00% in December 2025), lending rates and legacy loan pricing can keep repayment burdens heavy for large commercial facilities.

Wambui has long been a high-profile figure in Kenyan business and political reporting. Past coverage has described her as a Jubilee campaign financier, and court reporting around earlier matters placed Glee Hotel Ltd at the centre of her business footprint.

That public profile is exactly why this dispute is being read as more than a private debt fight: it is also a reputational test—of a bank’s enforcement resolve and of a prominent borrower’s ability to renegotiate time.

Glee’s own published positioning is not “just a hotel.” It is a meetings-and-events machine with multiple venues, large event capacity, and resort-style amenities designed to monetise corporate offsites, diplomatic traffic, weddings, and conferences.

That matters because valuation arguments often turn on whether the asset is assessed as:

a distressed, forced-sale property, or

an operating business with stabilising revenues and long-term earning power.

When judges hesitate to stop a bank, it’s often because they see default as clear and enforcement as procedurally sound. When judges do stop a sale (even temporarily), it’s often because the process looks rushed, the valuation looks contestable, or the borrower shows credible steps toward settlement—usually backed by concrete payments or a bankable restructuring proposal.

Equity’s public argument in cases like this is typically straightforward: once a facility is non-performing, the bank has a duty to protect depositors and enforce securities. The unspoken part is equally important: large defaults change risk appetite. If a bank absorbs a prolonged, high-visibility impairment, credit committees often tighten terms for other developers—more collateral, stricter covenants, more conservative project finance.

With the February 5, 2026 date repeatedly cited in reporting, three things become decisive in the coming days:

Whether the High Court grants interim injunctive relief (even a short pause can shift leverage).

Whether a fresh valuation battle emerges—and which valuer the court finds more credible.

Whether there is a restructuring proposal with real money attached (courts are more receptive when a borrower demonstrates capacity to cure or meaningfully reduce arrears, not just promises).

Glee is a symbol of Nairobi’s new luxury corridor and the city’s bet on “bleisure” demand—business travel that behaves like leisure. But this fight is also a snapshot of Kenya’s current capital cycle: ambitious projects built on debt, now meeting a banking sector that is more enforcement-minded amid elevated NPL risk.

If the court allows the auction to proceed, it will be read as a hard signal that even politically visible borrowers face the same enforcement calculus as everyone else. If the court pauses it, the message will be different: that valuation integrity and procedural discipline remain the guardrails that can slow even the biggest lender—at least long enough to renegotiate survival.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Other hot threads

E-sports and Gaming Community in Kenya

Active 8 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 8 months ago

Popular Recreational Activities Across Counties

Active 8 months ago

Investing in Youth Sports Development Programs

Active 8 months ago

Key figures and persons of interest featured in this article