We're loading the full news article for you. This includes the article content, images, author information, and related articles.

Airtel Kenya is strategically partnering with Elon Musk's satellite internet provider, Starlink, in a bold maneuver to disrupt the local telecommunications sector and challenge Safaricom's long-standing dominance in the mobile broadband market.

Airtel Kenya is strategically partnering with Elon Musk's satellite internet provider, Starlink, in a bold maneuver to disrupt the local telecommunications sector and challenge Safaricom's long-standing dominance in the mobile broadband market.

In a groundbreaking move for East African telecommunications, Airtel Kenya has announced a strategic integration with Starlink. This partnership aims to leverage low-Earth orbit satellite technology to blanket Kenya with high-speed internet, bypassing traditional terrestrial infrastructure limitations.

For decades, Kenya's digital landscape has been defined by the unyielding dominance of Safaricom. However, Airtel’s alliance with Starlink represents a seismic shift in the broadband wars. By addressing the critical “last mile” connectivity issue in remote and underserved counties, Airtel is not just upgrading its network; it is attempting to rewrite the rules of digital inclusion in East Africa’s largest economy. The implications for e-commerce, remote education, and telemedicine across the nation are truly monumental.

The current internet infrastructure, heavily reliant on fiber optic cables and terrestrial cell towers, has inherently favored urban centers like Nairobi, Mombasa, and Kisumu. Rural populations in the vast arid and semi-arid lands (ASALs) of Northern Kenya have historically been left behind, suffering from sluggish 3G networks or total digital blackouts. Starlink’s satellite constellation fundamentally solves this geographical penalty. By integrating this technology, Airtel can instantly offer high-speed, low-latency internet to a pastoralist in Turkana with the same reliability as a corporate executive in Westlands. This levels the playing field, unlocking the untapped economic potential of the rural populace.

The cost of internet access has always been a barrier in Kenya. While mobile data is relatively cheap compared to global standards, fixed home and business broadband remains prohibitively expensive for the average citizen. Starlink’s initial solo entry into the Kenyan market was met with enthusiasm but tempered by the high upfront cost of the receiver hardware, which was initially priced at over KES 89,000. Through this partnership, Airtel is expected to heavily subsidize or bundle the hardware costs, integrating the satellite connection seamlessly into their existing mobile and home data packages. This financial engineering is crucial for mass adoption.

Safaricom, commanding a massive lion's share of the market, will undoubtedly feel the pressure. Their recent investments in 5G infrastructure have been aggressive, but deploying 5G base stations across Kenya’s vast 580,000 square kilometers is a capital-intensive marathon. Airtel’s satellite gambit allows them to leapfrog this physical rollout. It is a classic asymmetric business strategy: striking where the giant is constrained by the physical world. Market analysts predict a fierce price war in the coming months, which ultimately benefits the Kenyan consumer through reduced tariffs and massively improved service quality.

However, this celestial alliance is not without its earthly challenges. The Communications Authority of Kenya (CA) maintains stringent oversight over data sovereignty, spectrum allocation, and national security. Transmitting Kenyan internet traffic through foreign-owned satellite networks raises legitimate questions about data interception and compliance with the Kenyan Data Protection Act. Airtel and Starlink must navigate this regulatory minefield carefully, ensuring that their infrastructure meets local compliance standards without compromising global efficiency. Furthermore, the reliance on space-based infrastructure introduces new vulnerabilities, including solar flares and orbital debris, which could theoretically disrupt services.

There is also the question of network capacity. While Starlink is revolutionary, its total bandwidth over a specific geographic area is not infinite. As more users log on across the African continent, network congestion could become a reality, potentially degrading the promised high speeds during peak hours. Airtel will need to manage user expectations carefully and optimize data routing to maintain a premium user experience. Despite these hurdles, the technological leap is undeniable and positions Kenya at the cutting edge of global connectivity.

The ripple effects of widespread, high-speed internet cannot be overstated. From agricultural tech startups in the Rift Valley utilizing real-time global weather data, to local content creators streaming in high definition without buffering, the economic multipliers are vast.

Airtel’s partnership with Starlink could catalyze the next massive wave of Kenyan tech unicorns, fundamentally changing how business is done.

“This deal is not just about faster downloads; it is about connecting every corner of Kenya to the global digital economy,” an industry insider noted, summarizing the transformative potential of the Airtel-Starlink venture.

Keep the conversation in one place—threads here stay linked to the story and in the forums.

Sign in to start a discussion

Start a conversation about this story and keep it linked here.

Other hot threads

E-sports and Gaming Community in Kenya

Active 9 months ago

The Role of Technology in Modern Agriculture (AgriTech)

Active 9 months ago

Popular Recreational Activities Across Counties

Active 9 months ago

Investing in Youth Sports Development Programs

Active 9 months ago

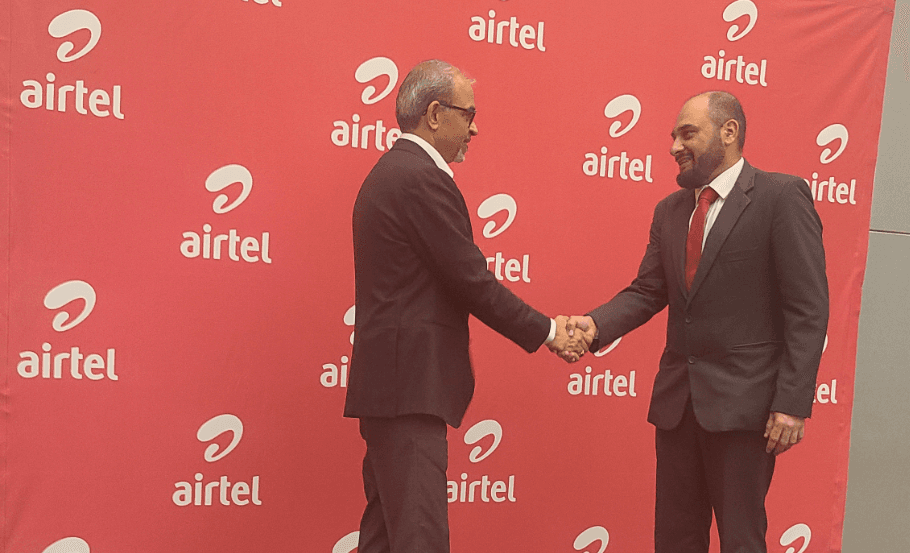

Key figures and persons of interest featured in this article